Raj Ras

- In NEWS: Bawariya tribe for Bulandshehar Case

- What: Members of Bawariya tribe are accused as culprits and Bawariya tribe has been called as notorious tribe.

- How can a community or tribe be called notorious? Well because

- History:

- British in 1871 passed Criminal Tribes Act and labeled over 200 of such communities as notified tribes for criminal tendencies.

- Post Independence, Government repealed the Criminal Act but introduced another law, the Habitual Offenders Act (1953) around 150 tribes have been labeled as de-notified tribes.

- These are tribes that have failed to integrate into Indian Society and so do not have sustainable livelihood means. Hence, they frequently engage towards criminal activities.

- Rajasthan: becomes first state to approve sewage & wastewater policy.

- All district headquarters, heritage cities, and cities in the state with population more than one lakh are included in the policy.

- Wastewater would be used for agriculture, irrigation purposes.

- Person in NEWS:

- Anant Maheshwari has been appointed as President of Microsoft India

- Translator Anita Gopalan has been awarded the 2016 PEN/Heim Translation Fund Grants for her English translation of Hindi novel Simsim written by Geet Chaturvedi.

- Maoist chief Pushpa Kamal Dahal (Prachanda)was on Wednesday elected by lawmakers as Nepal’s Prime Minister for a second time

- Swell Waves warning in Kerala

- What are Swell Waves: (locally called as Kallakdal)

- These are 3-4 meters high waves that are result of high onshore winds and Spring tides associated with new moon phase occurring simultaneously.

- Causes floods in low-lying areas.

- Indian National Centre for Ocean Information Services (INCOIS) says source of high onshore winds is three-day storm that occurred in the Southern Ocean (near Antarctica).

- Rajya Sabha passes GST Bill.

- Today we shall discuss how GST, will be different from present system

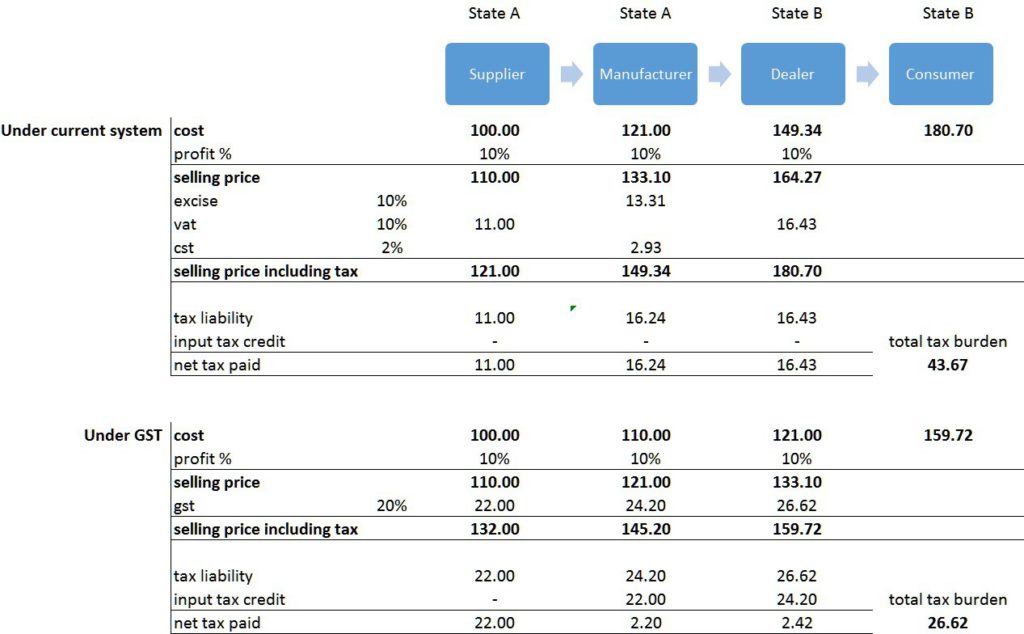

- In present times, there are multiple taxes, which can be grouped under two groups Central & State taxes.

- Here is an example:

- Now, these taxes apply in different rates/ manner to different products.

- What will GST do?

- 1st and foremost, it shall remove all these multiple taxes and replace it with single tax. GST. (So if nothing it shall be easy to understand).

- 2nd: It shall stop cascading effect of tax. What is that?

- Cascading of tax is simply tax on tax. In present system when seller buys an item from manufacturer he pays certain tax. But when he sells this item to customer, the customer pays tax on total price, which includes this tax also. Hence there is tax on tax. GST avoids this tax by means of output tax- input tax. Below example will make tis more clear.

Press Information Bureau Release on GST: FAQ on GST

[themencode-fb-page-widget page=”https://www.facebook.com/Rajras-1835370626603310″ width=”250″ height=”50″ hide_cover=”true” show_faces=”false” show_posts=”false”]

You can visit Rajras (Raj ras) – for knowledge/information related to RAS/IAS syllabus, study material & current affairs.