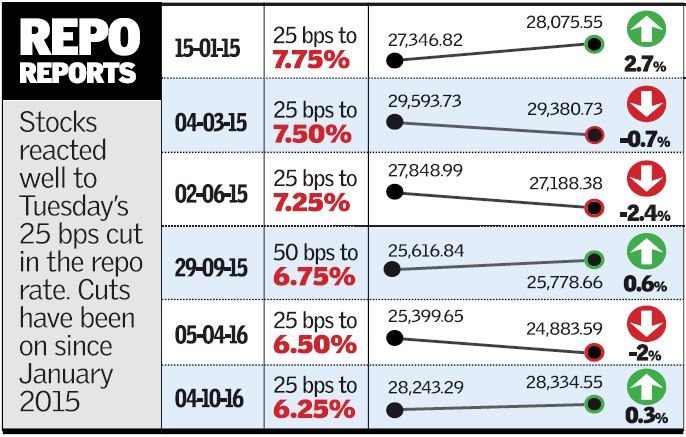

The Reserve Bank of India (RBI) in its fourth bi-monthly monetary policy review for year 2016-17 has cut the repo rate by 25 basis points to 6.25%.

Key Reserve Ratio’s:

- Cash Reserve Ratio (CRR): 4%

- Statutory Liquidity Ratio (SLR): 20.75%

Key Policy Rates:

- Repo rate under the liquidity adjustment facility (LAF): 6.25%.

- Reverse repo rate under the LAF: unchanged at 5.75 %.

- Marginal standing facility (MSF) rate: 6.75%.

- Bank rate: 6.75%

Why RBI reduced Rate:

- The MPC has take this decision with the objective of achieving consumer price index inflation at 5 percent by Q4 of 2016-17. Retail inflation dropped to a five-month low of 5.05 per cent in August.

-

RBI Executive Director M.D. Patra hinted there was scope for policy interest rates to ease further when the neutral rate is 1.25 per cent. The neutral rate is the difference between the risk free rate and inflation — a key determinant of the policy rate.

- The central bank aims to achieve the 4 per cent inflation target within a range of +/- 2 per cent as the medium term objective, that is, by 2021.

Remember:

- Income increases (leads to)→ Inflation Increases (leads to) → RBI increases Rates (to counter inflation)

Repo-Rate Vs Stock Market History: