Union Budget 2026 Highlights & Key Takeaways present a concise overview of the major announcements, policy priorities, and fiscal measures introduced by the Government of India for the financial year. The budget focuses on economic growth, social welfare, infrastructure development, and fiscal discipline amid evolving domestic and global challenges. These highlights help in understanding the government’s vision, sector-wise impact, and key takeaways relevant for examinations and current affairs analysis.

Union Budget 2026-27

The Union Budget 2026–27, presented by Finance Minister Nirmala Sitharaman, focuses on economic growth, youth empowerment, infrastructure expansion, manufacturing strength, technology adoption, and inclusive development while maintaining fiscal discipline. The vision aligns with “Viksit Bharat 2047.”

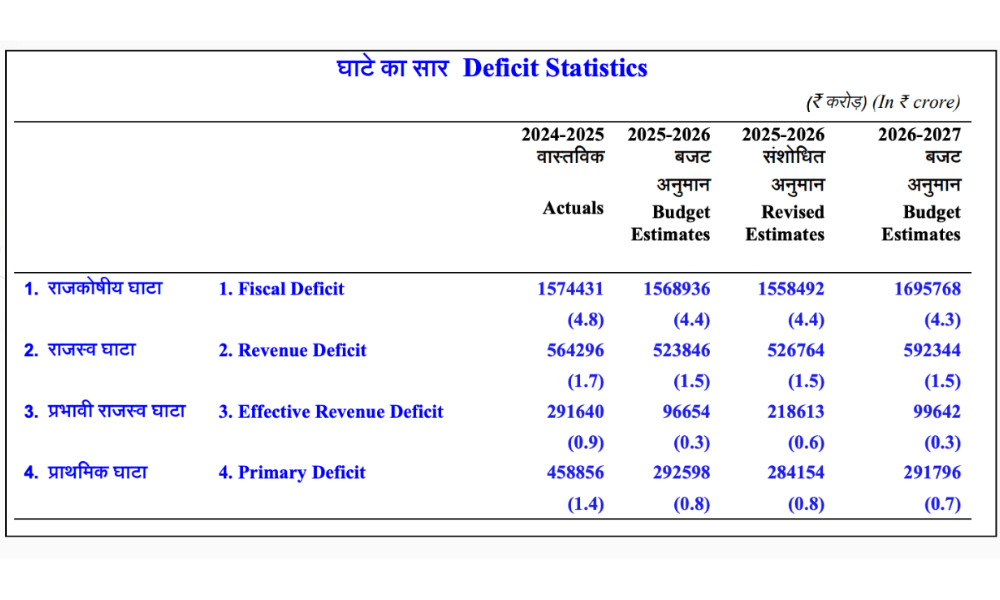

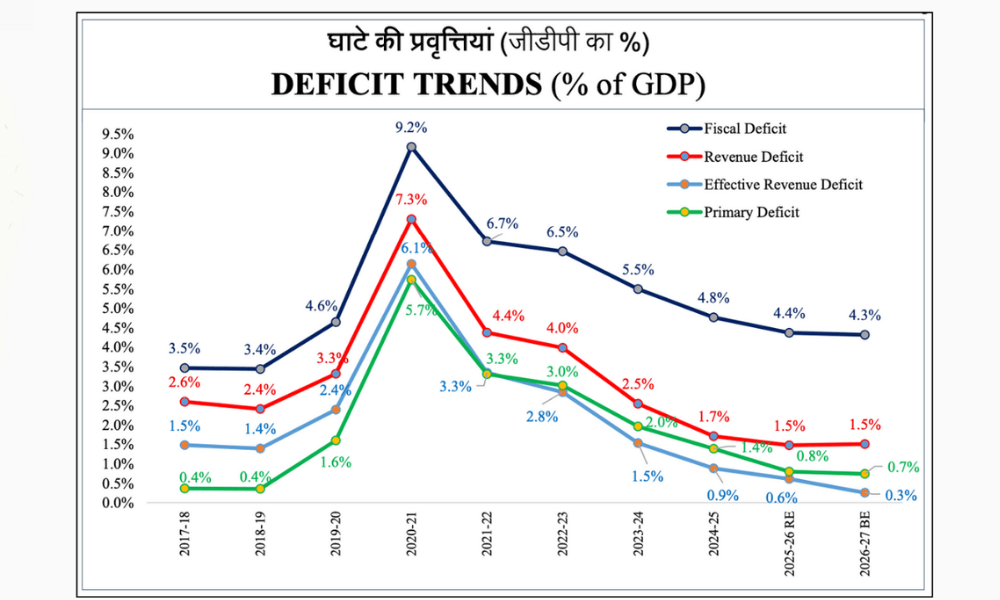

Deficit Statistics

(₹ करोड़) (In ₹ crore)

| Revised Estimates(2025-26) | Budget Estimates(2026-27) | Percent(%)(2026-27) | |

| Fiscal Deficit | 15,58,492 | 16,95,768 | 4.3 |

| Revenue Deficit | 5,26,764 | 5,92,344 | 1.5 |

| Effective Revenue Deficit | 2,18,613 | 9,96,42 | 0.3 |

| Primary Deficit | 2,84,154 | 2,91,796 | 0.7 |

Major Focus Areas

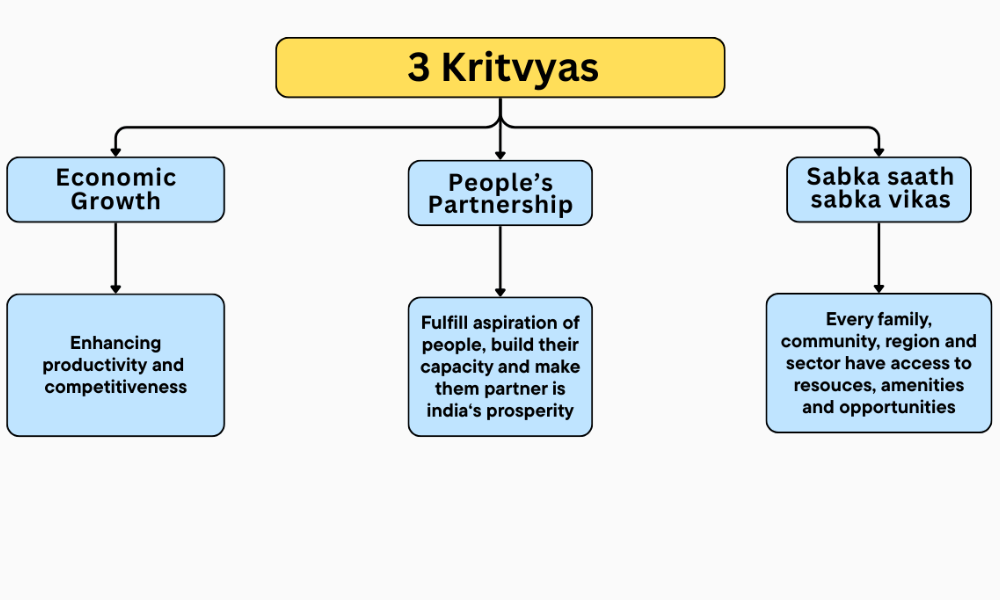

1. Focus on “Viksit Bharat” & 3 Kartavya

The Budget is built around three duties (Kartavya):

- Accelerate Economic Growth

- Fulfil Aspirations & Build Capacity

- Sabka Saath, Sabka Vikas – Inclusive development for all sections of society.

Key themes: Moderate Inflation, Sustained Growth (~7%), Fiscal Discipline, Structural Reforms, Domestic Manufacturing, Energy Security.

2. Manufacturing & Industry Boost

- Biopharma SHAKTI Scheme for biotech and pharma manufacturing.

- India Semiconductor Mission 2.0 for chip production.

- Electronics Components Manufacturing Scheme expansion.

- Revival of 200 Legacy Industrial Clusters.

- Dedicated Chemical Parks and Rare Earth Magnet Manufacturing.

- Textile Integrated Programme and support for Handloom & Handicrafts.

- Hi-Tech Tool Rooms in CPSEs.

- Incentives for Sports Goods Manufacturing.

- Duty exemptions on aircraft parts, microwave components, and export-oriented inputs.

3. MSME & Startup Support

- ₹10,000 crore SME Growth Fund.

- ₹2,000 crore top-up to Self-Reliant India Fund.

- Mandatory TReDS platform for MSME payments by CPSEs.

- Credit guarantee support for invoice discounting.

- Development of Corporate Mitras for compliance help in Tier-2 & Tier-3 cities.

- Removal of courier export value cap.

4. Infrastructure & Urban Development

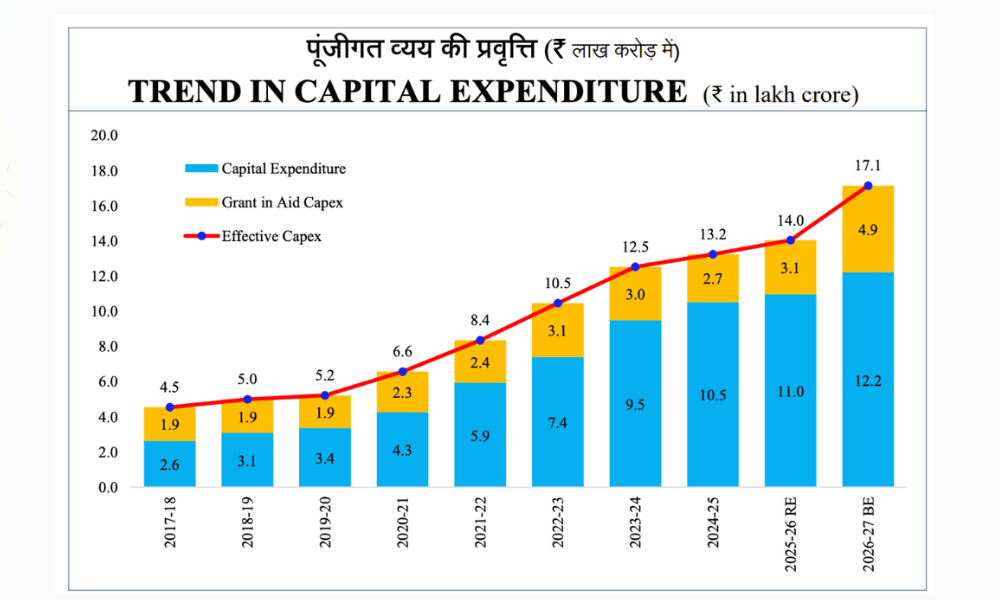

- Public Capital Expenditure increased to ₹12.2 lakh crore.

- New Dedicated Freight Corridors (East–West connectivity).

- 20 National Waterways to boost logistics.

- Coastal Cargo Promotion Scheme and Ship Repair Ecosystem.

- Seaplane Manufacturing & VGF Scheme.

- Development of City Economic Regions (CERs).

- 7 High-Speed Rail Corridors between major cities like Mumbai–Pune, Delhi–Varanasi, Chennai–Bengaluru.

5. Energy & Environment

Large investments were announced to strengthen infrastructure and urban growth:

- ₹20,000 crore CCUS Scheme (Carbon Capture).

- Customs duty exemptions for Lithium-Ion battery equipment, Solar Glass, and Critical Mineral Processing.

- Continued exemptions for Nuclear Power Projects till 2035.

- Incentives for Biogas-blended CNG.

6. Technology, AI & Innovation

- Push for AI-based governance tools.

- Bharat-VISTAAR AI integration for agriculture.

- Support for AVGC (Animation, VFX, Gaming) Labs in schools and colleges.

- IT sector relief through Safe Harbour Rules and faster APA processing.

- Tax holidays till 2047 for foreign cloud/data-centre companies operating in India.

7. Education, Skills & Employment

- Education to Employment Committee for services growth.

- 5 University Townships near industrial corridors.

- Girls’ STEM Hostels in every district.

- Training of 1.5 lakh caregivers.

- New National Institute of Design in Eastern India.

- Khelo India Mission expansion.

8. Healthcare & AYUSH

- 3 New All India Institutes of Ayurveda.

- Upgrading AYUSH labs and pharmacies.

- NIMHANS-2 and mental health institute upgrades.

- Emergency & Trauma Centres in district hospitals.

- Development of Medical Tourism Hubs.

9. Agriculture & Rural Development

- Focus on High-Value Crops – Coconut, Cocoa, Cashew, Sandalwood.

- 500 Reservoirs & Amrit Sarovars development.

- Strengthening Fisheries Value Chain.

- AI-enabled AgriStack Integration.

- Support for Animal Husbandry & Veterinary Infrastructure.

- SHE-Marts for women entrepreneurs.

10. Tourism, Culture & Sports

- Development of 15 Archaeological Sites.

- Eco-Tourism Trails – Mountain, Turtle, Bird-Watching.

- Buddhist Circuits in North-East.

- Global Big Cat Summit hosting.

- National Digital Tourism Knowledge Grid.

- Upskilling 10,000 Tourist Guides.

11. Financial Sector Reforms

- Incentives for Municipal Bonds.

- PFC & REC restructuring.

- New Corporate Bond Market Framework.

- STT increase on Futures & Options.

- High-Level Banking Committee for next growth phase.

12. Direct Tax Highlights

- New Income Tax Act 2025 effective April 2026.

- Reduced TCS rates for foreign tours, education, and medical remittances (2%).

- Extended ITR revision deadlines.

- Easier Form 15G/15H submission via depositories.

- MAT relief for non-residents.

- Small foreign asset disclosure scheme.

- Exemption on motor accident compensation interest.

- 17 Cancer Drugs exempted from customs duty.

13. Fiscal & Economic Indicators

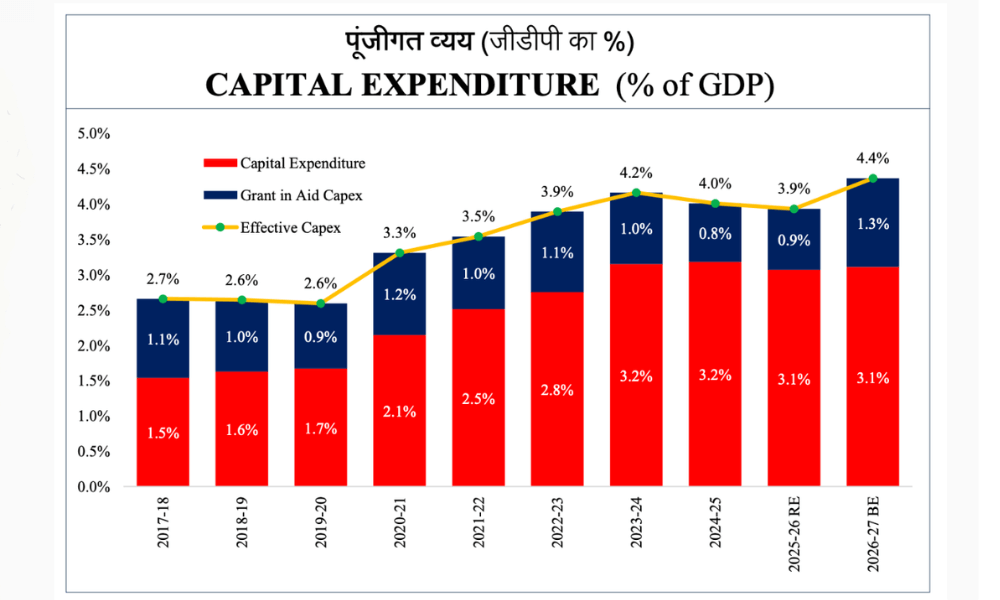

- Fiscal Deficit Target: 4.3% of GDP (2026-27).

- Debt-to-GDP Ratio: 55.6% (aim 50% by 2030).

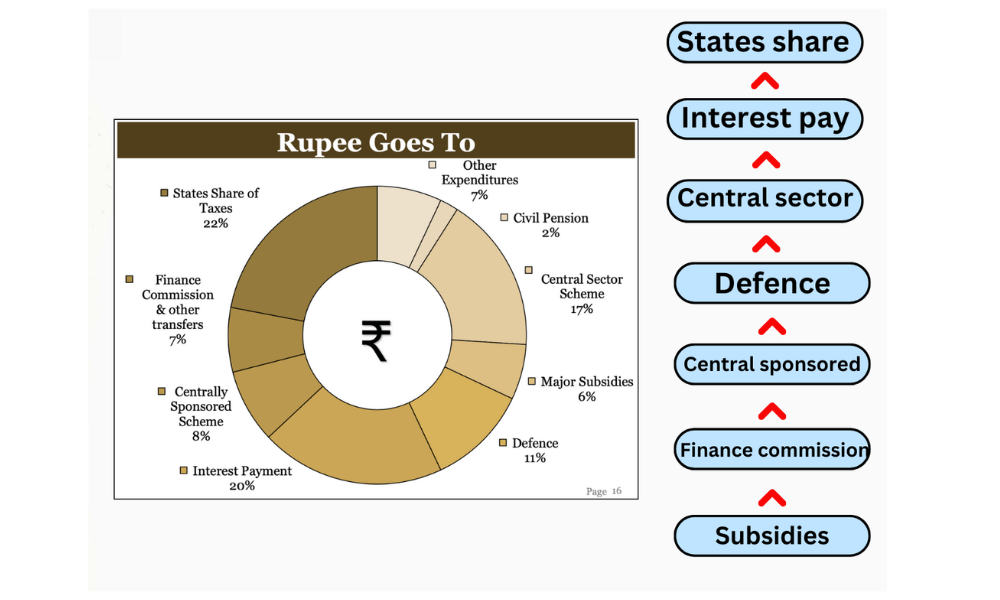

- Finance Commission Grants to States: ₹1.4 lakh crore.

- Continued focus on Fiscal Prudence & Stability.

The Union Budget 2026–27 balances growth, reforms, and inclusivity. With strong investment in infrastructure, manufacturing, AI, healthcare, education, and MSMEs, the government aims to create jobs, strengthen domestic industries, and move India steadily toward the goal of “Viksit Bharat 2047.”

Budget 2026 Highlights PDFs

| Budget 2026 Highlights | Download PDF |

| Budget at a Glance | Download PDF |

| Budget Speech | Download PDF |

| Deficit Statistics | Download PDF |

| Transfer of Resources to States and Union Territories with Legislature | Download PDF |

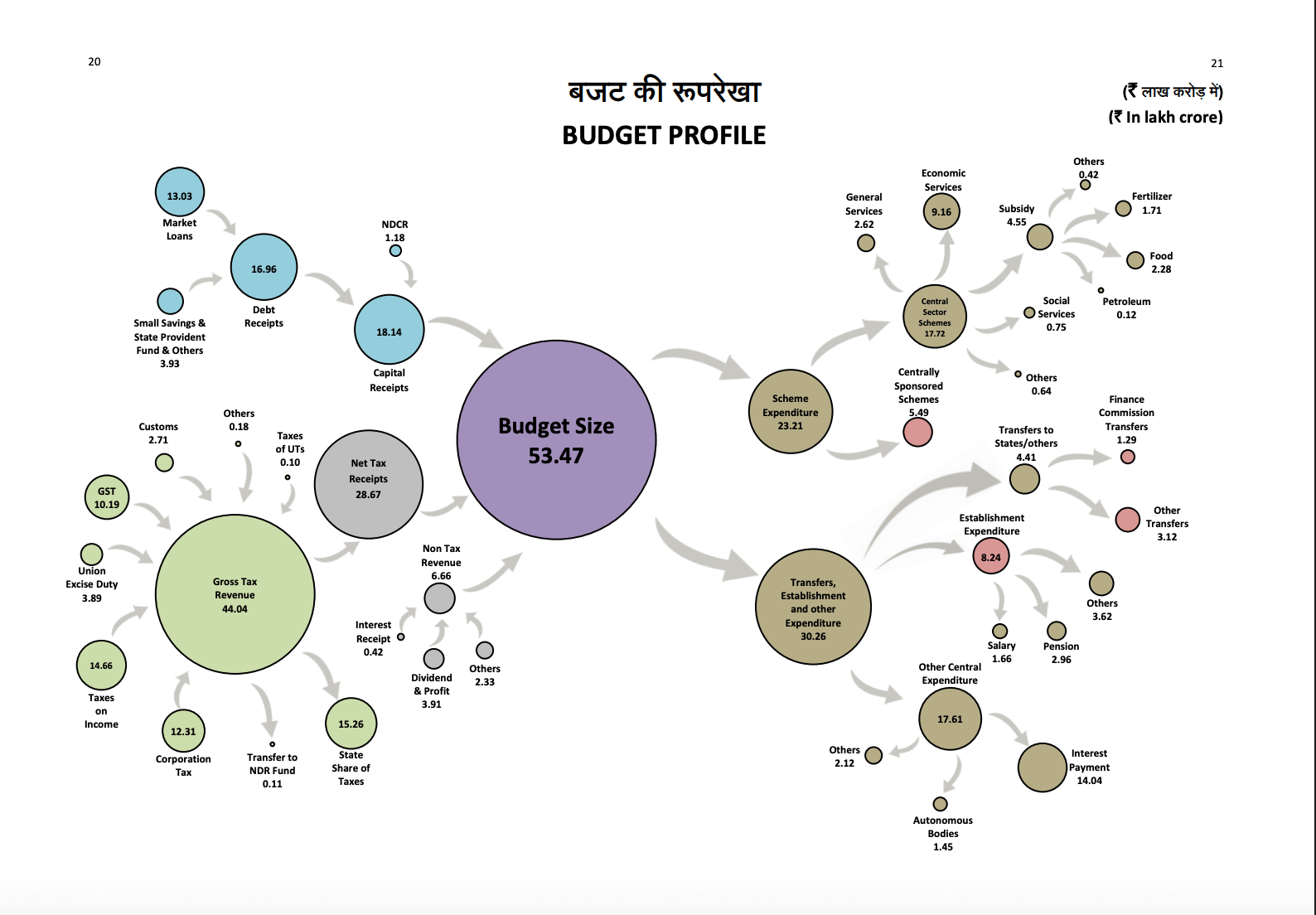

| Budget Profile | Download PDF |

| Receipts | Download PDF |

| Expenditure | Download PDF |

| Outlay on Major Schemes | Download PDF |

| Union Budget 2026 Highlights | Download PDF |

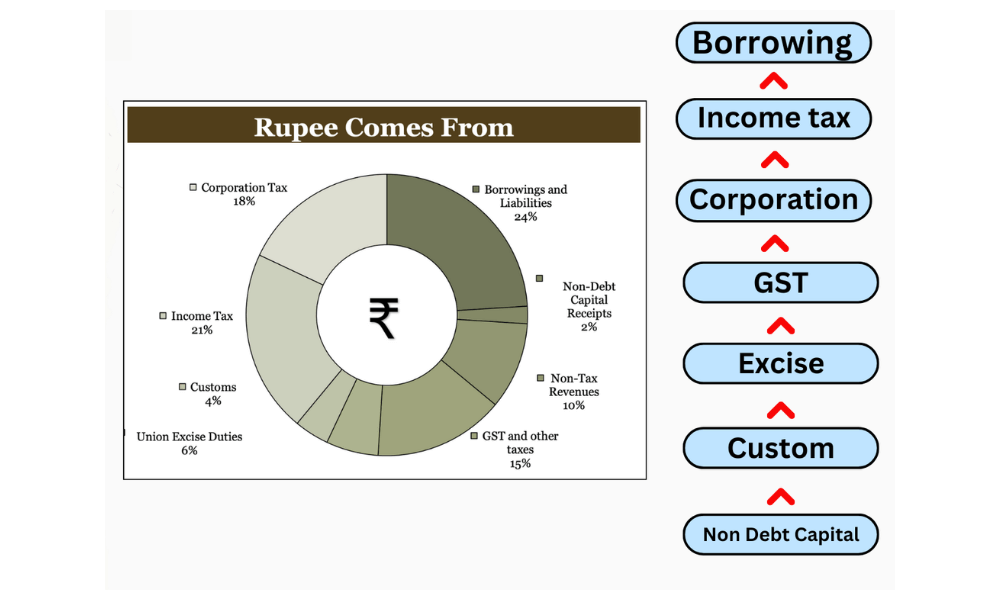

Income

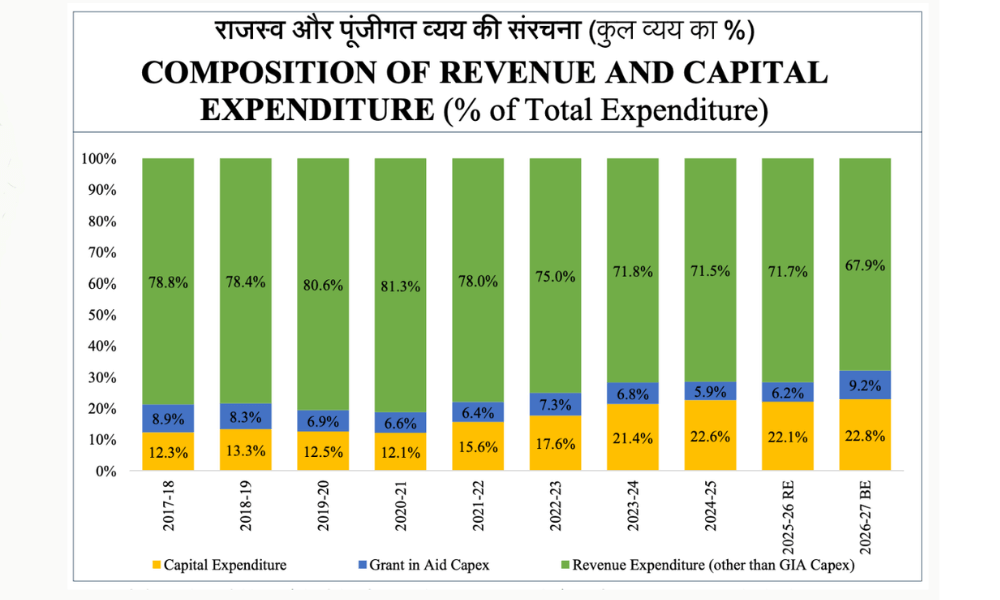

Expenditure

Capital Expenditure

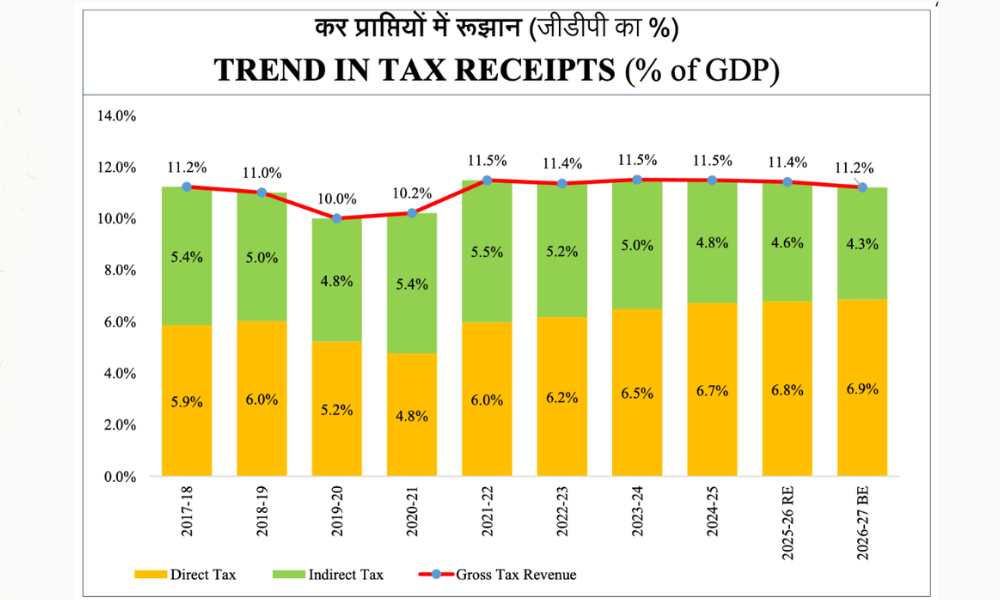

Tax