Stock market plays a vital role in financial management by providing businesses and investors with opportunities for growth and wealth creation. It serves as a platform for buying, selling, and managing securities, influencing economic stability and investment strategies. Understanding its dynamics is essential for effective financial decision-making.

Stock Market

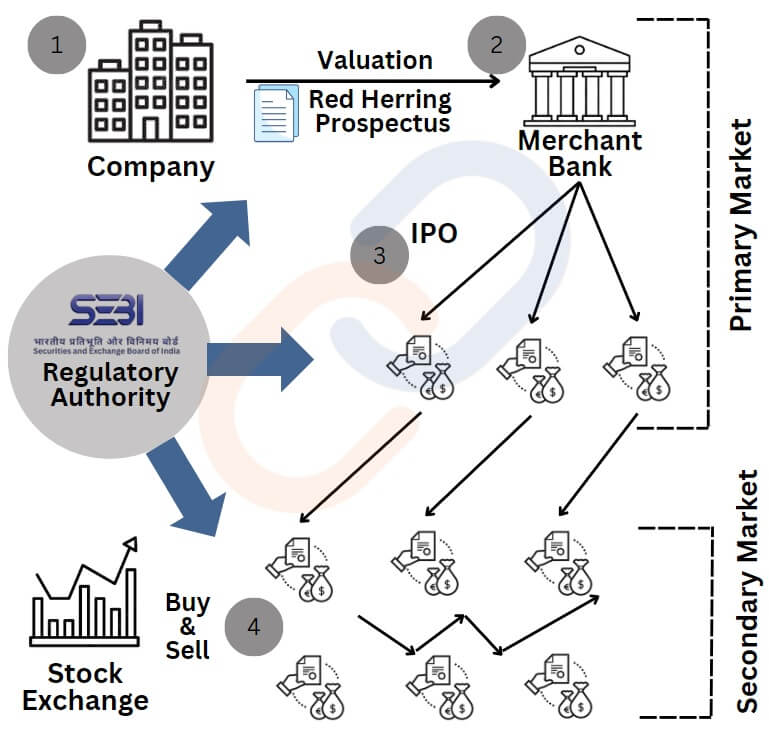

Primary Market-

- In the primary market, new stocks and bonds are sold to the public for the first time.

- In a primary market, investors can purchase securities directly from the issuer. Companies raise capital by selling shares to investors.

- Types of Primary Market Issues

- Initial public offering (IPO),

- Private placement,

- Rights issue,

- Preferred allotment, etc

Secondary Market-

It is a platform where already issued shares, bonds, and securities are traded. Eg. the Bombay Stock Exchange

- The secondary market is also known as the stock exchange/share market.

- Stock exchanges are regulated by SEBI (Securities and Exchange Board of India).

- The stock market is recognized under the Securities Contracts (Regulation) Act, 1956.

India has two primary stock exchanges:

The Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE). Here’s a brief overview of the stock markets in India:

1. Bombay Stock Exchange (BSE)

- Established: 1875

- Location: Mumbai

- Index: The BSE’s benchmark index is the S&P BSE Sensex, which consists of 30 of the largest and most actively traded stocks on the exchange.

2. National Stock Exchange (NSE)

- Established: 1992

- Location: Mumbai

- Index: The NSE’s benchmark index is the Nifty 50, comprising 50 major companies listed on the exchange.

- Electronic Trading: NSE is known for introducing electronic trading in India, which made the trading process more efficient and transparent.

Regulatory Body: The Securities and Exchange Board of India (SEBI) regulates the stock markets, ensuring transparency, investor protection, and fair trading practices.

Sensex (S&P BSE Sensex)

- Full Form: Sensitive Index

- Launched: 1986

- Managed by: Bombay Stock Exchange (BSE)

- Number of Companies: 30

- Criteria: The Sensex includes 30 of the largest and most financially sound companies listed on the BSE. These companies are selected based on various factors such as liquidity, market capitalization, and industry representation.

- Sector Representation: The Sensex covers various sectors of the economy, providing a broad reflection of the market.

- Benchmark: The Sensex is widely used as a benchmark index to gauge the performance of the Indian stock market. It is one of the oldest and most tracked indices in India.

Nifty 50

- Full Form: National Index Fifty

- Launched: 1996

- Managed by: National Stock Exchange (NSE)

- Number of Companies: 50

- Criteria: The Nifty 50 includes 50 of the largest companies listed on the NSE, selected based on their market capitalization, liquidity, and sector representation.

- Sector Representation: Like the Sensex, the Nifty 50 represents various sectors of the Indian economy, making it a well-diversified index.

- Benchmark: The Nifty 50 is a popular benchmark index in India, used by investors, fund managers, and analysts to track the overall market performance and make investment decisions.

Key Differences

- Number of Constituents: The Sensex comprises 30 companies, while the Nifty 50 includes 50 companies, making the Nifty slightly more diverse in terms of the number of companies represented.

- Stock Exchange: The Sensex is associated with the BSE, while the Nifty 50 is associated with the NSE.

- Sector Coverage: Both indices cover a wide range of sectors, but the exact composition and sector weightage may differ between the two.

Share Offering

Share Offering and related terms

- Share offering– when a company issues shares to the public to raise funds. Eg. IPO, FPO, Rights Issue….

- Initial Public Offering(IPO)– The first time a company offers its shares to the public. It is transitioning from a privately held company to a publicly traded one.

- Further Public Offering(FPO)- Additional issuance of shares by a company that is already publically traded. It is also known as Secondary Offering.

- Oversubscribed– When the demand for a newly issued stock is greater than the number of shares available.

- Undersubscribed– When the demand for a newly issued stock is less than the number of shares available.

- Rights Issues– An offering of additional shares to existing shareholders at a discounted price before they are offered to the public.

- Private Placement– A sale of shares to a specific group of investors rather than the general public.

- Underwriting– The investment bank/underwriter first buys the shares from the company and then sells them to the public.

- Offer price– The price at which shares are offered to the public in IPO, FPO.

- Listing– The process of registering the company’s shares on a stock exchange, allowing them to be traded by the public.

- Market Capitalization– The total market value of a company’s outstanding shares. Calculated as the share price multiplied by the number of shares outstanding. Eg. Stock Price Close (998.26) x Shares Outstanding (3,833.2 M) = Market Capitalization (3,826.5 B)

- Dividend– A portion of a company’s earnings distributed to shareholders.

Secondary Market

- Brokers

- Bring together Buyers and Sellers to aggregate the demand and supply and hence help in efficient price discovery

- All the Brokers are registered with the SEBI.

- Examples include Groww, Zerodha, Angel One, Upstox, etc.

- Depositories

- The organization that holds securities (like shares, debentures, bonds, government securities, mutual fund units, etc.) of investors in electronic form.

- Example: National Securities Depository Limited (for NSE) and Central Depository Services (India) Limited (BSE)

- Depository Participant

- Agent of the depository through which it provides depository services to investors. includes Banks, NBFCs, Brokers etc

- Clearing Corporations

- Guarantee that every buyer will get the securities which are bought by him and every seller of securities will get money for the securities sold by him.

- Example: Indian Clearing Corporation, NSE Clearing Ltd.

Terms related to Stock Exchange/ Stock Market

Market Capitalization

- Meaning: Calculated as ( Number of shares multiplied by their prices).

- Recent Development (Jan 2024): India’s market capitalization has reached $ 4.5 trillion (120% of GDP).

- Top 5 Countries in terms of Market Capitalization: US, China, Japan, Hong Kong, and India

Underwriting in IPO

- Agreement between Company and Investment Bank wherein Investment Bank facilitates issuance and sale of shares in the IPO. The underwriters would help determine the number of shares and price of shares in the IPO. At the same time, the underwriters commit to purchase shares if there is under-subscription in an IPO.

Greenshoe Option

- Option that enables the underwriters the right to sell additional shares beyond the offered shares to meet the excess demand

Long Position:

- The investor has bought Shares and owns them in the expectation that their price would increase

Short Position:

- The entity does not own shares but has borrowed shares in the expectation that its prices would decline.

Short-selling:

- Strategy wherein short-sellers borrow shares from shareowners and sell them in the market and expect that the prices would all later. They would then purchase shares at lower prices and make profits

Insider Trading

- Buying or selling Shares by individuals who have access to Confidential information about the company

- For example, the company is going to get a new tender. Its share prices are expected to increase in the future and it is known only to directors. Directors buy company shares at a lower price in the hope of selling later at a higher price.

Front Running

- Buying or selling shares by the Brokers or fund managers based upon the orders placed by clients.

Pump and Dump Scam

- Market Manipulator purchases shares of a company in bulk at lower prices and enters into an agreement with Financial Influencers/ Celebrities. Spread false news about the future increase in share prices of the Company through YouTube Videos/ Social Media. Encourage investors to purchase more shares of the company leading to an increase in its prices. Scam Manipulator sells the shares at a higher price and makes Profits

Poop and Scoop scam

- Market Manipulator enters into agreements with Financial Influencers/ Celebrities to spread false news about the future decrease in share prices of the company through YouTube Videos/Social Media. Encourage Investors to sell more shares of the company leading to a decrease in its prices. The manipulator buys the shares at lower prices expecting their prices to increase in the future.

Wash Trading

- Market Manipulator repeatedly buys and sells the same shares using two different accounts. Gives a false impression of increased trading activity and encourages investors to purchase shares leading to an increase in its prices. Manipulator sells the shares at a higher price and makes profits

Stock split

- A stock split is a corporate action in which a company divides its existing shares into multiple shares to boost the stock’s liquidity. Although the number of shares increases, the total market capitalization remains the same because the price per share decreases proportionally.

Buy-Back of Shares

- Buy-back is a procedure that enables a company to purchase its shares from its existing shareholders, usually at a price near or higher than the prevailing market price.