Important Land Laws in Rajasthan are a key part of the subject of Law, focusing on the legal framework governing land in the state. In this chapter, we study the following important legislations:

Rajasthan Tenancy Act 1955

Previous year Questions

| Year | Question | Marks |

| 2023 | What do you understand by the term “Sayar” under the Rajasthan Tenancy Act, 1955 ? | 5M |

| 2018 | What is meant by the expression ‘agriculturist’ under the Rajasthan Tenancy Act, 1955 ? | 2M |

| 2016 | State any five categories of land on which Khatedari Rights do not accrue under theRajasthan Tenancy Act, 1955. | 5M |

| 2016 | Who is treated as ‘Trespasser’ under the Rajasthan Tenancy Act, 1955 ? | 2M |

| 2016 Special | What are the ‘Primary Rights’ of tenants under the Rajasthan Tenancy Act, 1955 ? | 5M |

Objectives of Rajasthan Tenancy Act 1955

- Protect Tenant Rights: To secure tenants’ rights over agricultural land, including protection from unlawful eviction and assurance of fair treatment by landlords.

- Regulate Land Tenancy: To establish a clear legal framework governing land tenancy, covering tenant classifications, rights, obligations, and restrictions.

- Ensure Fair Revenue Collection: To organise the collection of land revenue in a manner that is equitable for both tenants and the government.

- Encourage Agricultural Development: To promote land improvements and productivity by providing tenants with security and incentives for investment in land.

- Facilitate Land Succession and Transfer: To create clear rules for inheritance and transfer of tenancy rights, ensuring stability for tenant families and continuity in land use.

Important Sections of Rajasthan Tenancy Act 1955

Section 5

- Agricultural year – shall mean the year commencing on the first day of July and ending on the thirtieth day of June next following;

- Agriculture – shall include horticulture,{Cattle breeding, dairy farming,{ Poultry farming and forestry development.

- Agriculturist – shall mean a person who by himself or by servants or tenants earns his livelihood wholly or principally by agriculture.

- Biswedar – shall mean a person on whom a village or portion of a village in any part of the State is settled on the Biswedari system and who is recorded as Biswedar or as an owner in the record of rights and shall include a Khatedar in the Ajmer area;

- Crops – shall include shrubs, bushes, plants and climbers such as rose bushes, plants, mehendi bushes plantains and papittas, but shall not include fodder and natural produce.

- Estate – shall mean Jagir land or interest in Jagir land held by a Jagirdar and shall include land or interest in land held by a Biswedar. or a Zamindar; or a Land owner.

- Grove-land – refers to a specific piece of land in the state where trees are planted in such a way that they prevent, or will prevent when fully grown, the land or a significant part of it from being used primarily for any other agricultural purpose. These planted trees together are considered a grove.

- Ijara or Theka – shall mean a farm or lease granted for the collection of rent,

- The area to which an Ijara or Theka relates shall be called the “Ijara or Theka area”

- “Ijaradar”/”Thekadar” shall mean the person to whom an Ijara or Theka is granted;

- Khudkasht – refers to land in any part of the state that is personally cultivated by an estate holder. It includes:

- land that was recorded as Khudkasht, Sir, Havala, Niji-jot, or Gharkhed in settlement records when this Act began, as per the law in force at that time, and

- land designated as Khudkasht after the Act began, under any law currently in force in the state.

- Land shall mean land which is let or held for agricultural purposes or for purposes subservient thereto or as grove land or for pasturage, including land occupied by houses or enclosures situated on a holding, or land covered with water which may be used for the purpose of irrigation or growing singhara or other similar produce but excluding abadi land; it shall include benefits to arise out of land and things attached to the earth or permanently fastened to anything attached to earth.

- Landless person – refers to an agriculturist who, by profession, either currently cultivates land or is reasonably expected to be able to cultivate land personally. However, this person does not own any land in their name or in the name of any joint family member, or they only own a small fragment of land.

- Malik refers to a Zamindar or Biswedar who, after the transfer of their estate to the State Government under the Rajasthan Zamindari and Biswedari Abolition Act, 1959, becomes the owner (Malik) of the Khudkasht land they personally cultivated.

- Rent – shall mean whatever is in cash or in kind or partly in cash and partly in kind payable on account of the use of (he occupation of land or on account of any right in land and, unless the contrary intention appears, shall include sayer,

- Occupied land – shall mean land which for the time being has been let out to, and is in the occupation of, a tenant and shall include khudkasht, and

- “unoccupied land” shall mean land which is not occupied;

- Pasture land – shall mean land used for the grazing of the cattle of a village or villages or recorded in settlement records as such at the commencement of this Act

- Sayar – includes any payment made by a lessee or licensee for the right to collect from unoccupied land various products such as grass, thatching grass, wood, fuel, fruits, lac, gum, long, pala, panni, water-nuts, or similar items. It also covers payments for refuse like bones or dung found on the surface, as well as rights related to fisheries, forest products, or the use of water for irrigation from artificial sources.

- Sub-tenant – refers to a person, regardless of the name they are called, who holds land from a tenant, including a Malik or a tenant from a landowner. This person is responsible for paying rent, or would be required to pay rent based on a contract, whether it is expressed or implied.

- Tenant refers to the person responsible for paying rent, or who would be required to pay rent based on a contract, whether expressed or implied. Unless stated otherwise, it includes:

- (a) In the Abu area – permanent tenant or a protected tenant.

- (b) In the Ajmer area – ex-proprietary tenant, an occupancy tenant, a hereditary tenant, a non-occupancy tenant, a Bhooswami, or a Kashtkar.

- (c) In the Sunel area, an ex-proprietary tenant, a pakka tenant, or an ordinary tenant.

- (d) A co-tenant.

- (e) A grove-holder.

- (f) A village servant.

- (ff) A tenant holding land from a landowner.

- (g) A tenant of Khudkasht.

- (h) A mortgagee of tenancy rights.

- (i) A sub-tenant.

- However, it does not include a grantee who pays a favourable rent, an Ijaredar, a thekadar, or a trespasser.

- Trespasser – shall mean a person who takes or retains possession of and without authority or who prevents another person from occupying land duly let out to him;

- Nalbat – shall mean a payment in cash or in kind to the owner of a well by some person for using that well for irrigation.

- Zamindar – shall means a person on whom a village or portion of a village in any part of the State is settled on the Zamindari system and who is recorded as such in the record of rights and shall include a proprietor।

- Agricultural worker – shall mean a person who is not a tenant but works as a labour on the field or fields of a tenant lying within the village of his residence

Section 9 : Khudkasht –

- refers to land in any part of the state that is personally cultivated by an estate holder. It includes:

- land that was recorded as Khudkasht, Sir, Havala, Niji-jot, or Gharkhed in settlement records when this Act began, as per the law in force at that time, and

- land designated as Khudkasht after the Act began, under any law currently in force in the state.

Section 10 :Succession and Transfer

- The right to Khudkasht passes to the heir of the estate holder.

- Khudkasht rights are generally non-transferable except in cases of exchange, partition, or gift for maintenance.

Section 12 – Extinction of Khudkasht Right:

- Khudkasht rights end if:

- There is no successor.

- The land is transferred illegally (other than by exchange or by partition of the Khudkasht or by gift for the purpose of maintenance)

- Khatedari rights are granted to someone else.

- The holder becomes a Khatedar tenant under Section 13.

Section 14 – Classes of tenants

- For the purposes of this Act, there shall be the following classes of tenants,

- Khatedar tenants,

- Maliks,

- Tenants of Khudkasht

- Gair Khatedar tenants.

- Khatedar tenants,

Section 15 – Khatedar tenants

- A person who, at the commencement of the Act, is a tenant of land (other than as a sub-tenant or tenant of Khudkasht).

- A person who, after the commencement of the Act, is admitted as a tenant, excluding sub-tenants, tenants of Khudkasht, or an allottee of land under the Rajasthan Land Revenue Act, 1956.

- A person who acquires Khatedari rights as per this Act, the Rajasthan Land Reforms and Resumption of Jagir Act, 1952, or any other law currently in force.

- Exceptions to Khatedari Rights:

- Khatedari rights do not apply to tenants who were temporarily allotted land in the Gang Canal, Bhakra, Chambal, Jawai project areas, or any other area as notified by the State Government.

Section 16A – Tenant of Khudkasht :

- A person lawfully leasing Khudkasht land from an estate holder at the start of the Act or afterward will be considered a tenant of that Khudkasht land. However, if the estate holder becomes a Khatedar tenant of the Khudkasht land, then this tenant will become a sub-tenant under that Khatedar tenant.

Section 17 – Ghair Khatedari Tenant :

- Any tenant who is not a Khatedar tenant, a tenant of Khudkasht, or a sub-tenant is considered a Ghair Khatedari tenant.

Section 16 – Land in which Khatedari rights shall not accrue

- Khatedari rights will not accrue in the following types of land:

- Pasture land.

- Land for casual cultivation in river/tank beds.

- Water-covered land used for Singhara or similar crops.

- Shifting or unstable cultivation land.

- Gardens owned by the State Government.

- Land held for public purposes or utility works.

- Military grounds or cantonments.

- Land within railway or canal boundaries.

- Government forest boundaries.

- Municipal trenching grounds.

- Land held by educational institutions for agriculture or playgrounds.

- Government agricultural or grass farms.

- Land necessary for water flow to village drinking sources.

Chapter III C – Primary Rights of Tenants

- Rights to residential house

- Right to written lease and counterparts

- Attestation of leases in lieu of Registration

- Prohibition of premium or Forced Labour

- Prohibition of payment other than rent.

- Right to Use of materials in land area

CHAPTER IV

Section 44 – Right to Let or Sub-Let

- A Khudkasht holder can lease their land, and a tenant can sub-let their land, but only under the restrictions set by this Act. However, sub-letting does not relieve a tenant of their responsibilities toward the landholder.

Section 44 – Restrictions on Letting and Sub-Letting

- Khudkasht holders, landholders, or Khatedar tenants cannot lease or sub-let their land for more than five years at one time. However, for specific purposes prescribed by the State Government, leases can be up to 30 years, with an additional 10-year extension.

- After a lease or sub-lease term ends, a new lease for the same land cannot be issued within 2 years.

- Gair Khatedar tenants can sub-let their land only for one year.

Chapter V – Surrender, Abandonment & Extinction Surrender of Tenancies

Section 55 – Surrender of Holding

- A tenant, unless bound by a lease to stay another year, can surrender their holding by May 1 by giving possession to the Tehsildar or Municipal Chairman, even if it’s sub-let or mortgaged.

Section 56 – Notice to Landholder

- The tenant must notify the landholder 30 days before May 1 if they plan to surrender.

Section 56 – Surrender on Rent Increase

- If a court order raises rent, a tenant can surrender within 30 days of the order, effective on the rent increase date, without further rent liability.

Section 57 – Surrender on Rent Increase:

- If rent is increased by court order, the tenant can surrender the holding within 30 days of the order, effective from the date the increase applies, with no further rent obligation.

Section 60 – Abandonment of Tenancies

- A tenant who stops cultivating and leaves the area keeps their interest in the holding if they appoint someone to pay the rent and notify the landholder in writing.

- If the appointed person is:

- someone eligible to inherit the tenant’s interest, or

- managing for an heir,

- the tenant loses their interest after seven years unless they resume cultivation within this period, at which point the interest passes to the heir.

- If the appointed person doesn’t meet these criteria, the tenant is presumed to have abandoned the holding once the subletting period ends, unless they return to cultivate.

Section 63 – Extinguishment of Tenancy

- A tenant’s interest in their holding or a part thereof shall be extinguished if:

- The tenant dies without leaving an heir entitled under the provisions of this Act.

- The tenant surrenders or abandons the holding in accordance with the provisions of this Act or the Rajasthan Land Revenue Act.

- The land is acquired under the Land Acquisition Act, 1894.

- The tenant loses possession, and the right to reclaim possession is barred by limitation.

- The tenant is ejected in accordance with the provisions of this Act.

- The tenant acquires or inherits all rights of the landholder, or the landholder acquires the tenant’s rights.

- The tenant sells or gifts the holding as permitted under this Act.

- The tenant migrates to a foreign country without a valid passport or lawful authority.

- The allotment of the land is cancelled or ordered to be resumed under the provisions of the Rajasthan Land Revenue Act, 1956, or other current laws.

Chapter XI – Ejectment

Ensures that tenants are protected against wrongful eviction while enabling landholders to remove tenants who violate specific terms or misuse the Land.

- Grounds for Ejectment :

- Failure to pay rent,

- Breach of tenancy terms,

- Unlawful use of land, or

- Cultivating land not legally entitled to them.

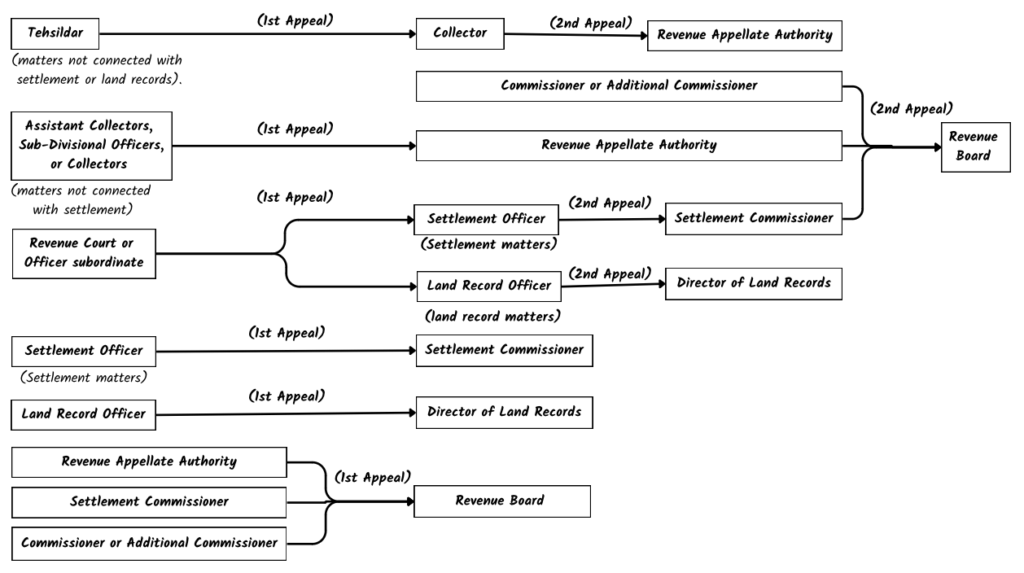

Chapter XV – Revenue Courts

- The powers of revenue courts under the Rajasthan Tenancy Act are structured by hierarchy and include ordinary, inherent, and additional powers to enable different levels of authority to handle tenancy matters effectively.

- Ordinary Powers :

- Each grade of revenue court has specific authority to resolve cases as listed in the Third Schedule.

- Tehsildars can handle cases not involving the State Government and with a monetary value below Rs. 300.

- Cases beyond this value or involving the State must be handled by an Assistant Collector.

- Inherent Powers :

- A Revenue Appellate Authority has the powers of a Collector, Sub-Divisional Officer, Assistant Collector, and Tehsildar.

- A Collector holds powers of a Sub-Divisional Officer, Assistant Collector, and Tehsildar.

- A Sub-Divisional Officer has powers of an Assistant Collector and Tehsildar.

- An Assistant Collector has the powers of a Tehsildar.

- Additional Powers :

- The State Government may grant:

- A Naib Tehsildar the powers of a Tehsildar,

- A Tehsildar the powers of an Assistant Collector, and

- An Assistant Collector the powers of a Sub-Divisional Officer or Collector.

- The State Government may grant:

- Subordination of Revenue Courts : The general superintendence and control over all revenue courts shall be vested in the Board, and all such courts shall be subordinate to the Board. Subject to this superintendence, control, and subordination:

- All Additional Collectors, Sub-Divisional Officers, Assistant Collectors, and Tehsildars in a district shall be subordinate to the Collector of that district.

- All Assistant Collectors, Tehsildars, and Naib-Tehsildars in a subdivision shall be subordinate to the Sub-Divisional Officer of that subdivision.

- Additional Tehsildars and Naib-Tehsildars in a Tehsil shall be subordinate to the Tehsildar of that Tehsil.

Appeals

Appeals from original decrees(First Appeal)

- If a decree is passed by

Appeal from appellate decree (Second Appeal)

- If an appeal is heard by the Collector, the appeal from their decision goes to the Revenue Appellate Authority.

- If an appeal is heard by the Revenue Appellate Authority, you can appeal further to the Board on specific grounds like:

- If the decision goes against the law or established legal practices.

- If an important legal issue or fact wasn’t addressed.

- If there were procedural errors that could have affected the decision.

- If the decision contradicts the weight of evidence, especially in questions of fact.

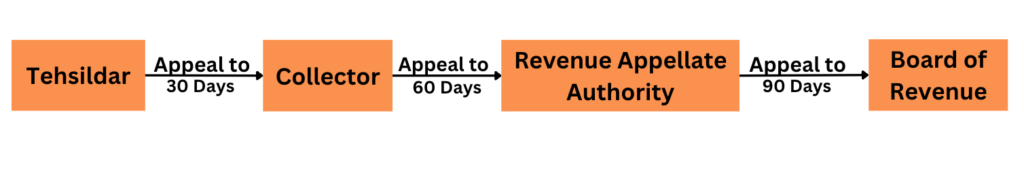

- Appeals from Orders: appeal against a final order passed on certain applications

- If the order is made by a Tehsildar, appeal to the Collector.

- If the order is made by an Assistant Collector, Sub-Divisional Officer, or Collector, appeal to the Revenue Appellate Authority.

- If the order is made by the Revenue Appellate Authority, appeal to the Board.

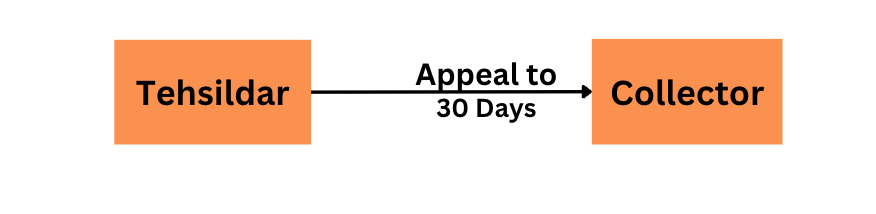

- Time limits for filing appeals :

- Appeal to the Collector : Must be filed within 30 days from the date of the decree or order.

- Appeal to the Revenue Appellate Authority : Must be filed within 60 days from the date of the decree or order.

- Appeal to the Board : Must be filed within 90 days from the date of the decree or order.

Conflict of Jurisdiction

- Doubt on Jurisdiction : If a civil or revenue court is unsure whether it has jurisdiction over a case, it can send the case record and reasons for doubt to the High Court for guidance.

- Disagreement Between Courts – send the case and reasons to the High Court.

- Binding Order – High Court’s decision is final

Rajasthan Land Revenue Act, 1956

Previous year Questions

| Year | Question | Marks |

| 2021 | State the contents of “Record of Rights” under the Rajasthan Land Revenue Act, 1956. | 5M |

| 2021 | Define the term ‘Nazul Land’. | 2M |

| 2018 | Do you agree to the view that the expression ‘annual register’ as used in the Rajasthan Land Revenue Act, 1956 is wider than the expression ‘record of rights’ ? Comment. | 5M |

| 2016 Special | Define ‘Nazul Land’ under the Rajasthan Land Revenue Act, 1956. | 2M |

Objective of Rajasthan Land Revenue Act, 1956

To consolidate and amend land-related laws, covering:

- Appointment, powers, and duties of Revenue Courts, Revenue Officers, and Village servants

- Preparation and maintenance of maps and land records

- Facilitation of revenue administration, including:

- Settlement of revenue and rent

- Regulation of estate partitioning

- Efficient collection of revenue

- Management of related matters incidental to revenue administration.

Section 3: Interpretation

- Land Records Officer : Refers to the collector and also includes the Additional or Assistant Land Records Officer.

- Nazul Land : Refers to abadi (inhabited) land within the limits of a municipality, panchayat circle, village, town, or city that belongs to the State Government.

- Village : shall mean the tract of land which ha sbeen recognised and recorded, or may here after be recognised & recorded to be a village;

- Recognised Agent :

- Refers to a person authorized in writing by a party

- Authorised to make appearances, applications, and perform acts on behalf of the party, subject to rules under this Act.

- Land – Includes pasture lands, public wells, and land related to Johads and Talabs.

- Chahi land: If land is intentionally left fallow or dry to avoid proper assessment, it will be treated as Chahi.

The Board of Revenue

Section 4: Establishment of Board of Revenue

- Board Composition: Consists of a Chairman and 3-20 members.

- Qualifications: Set by State Government, including methods of selection and service conditions.

- Validity: The Board’s constitution remains valid despite vacancies.

Tenure: Members serve at the Governor’s pleasure.

Place of Sitting

- Headquarters: Located in Ajmer, with authority to sit elsewhere within jurisdiction as per State Government directives.

Powers of the Board

- Highest Revenue Court: Functions as the apex court for revenue appeals, revisions, and references.

- The High Court’s decision is final in disputes over jurisdiction between civil and revenue courts.

Additional Powers: As assigned by the Government or applicable law.

Supervision → Holds general superintendence over all subordinate revenue courts and officers.

Jurisdiction Exercise

- Exercise of Jurisdiction: By the Chairman/a single member, or a multi-member bench.

- Special Appeal: A party can appeal a single-member decision to a larger bench within one month, with appropriate member approval.

Referral to Bench

- Legal Questions: Chairman or single member may refer significant legal questions or document interpretations to a bench for opinion.

Referral to High Court

- If a bench finds a legal question of public importance, it can refer the question to the High Court for an opinion.

Decision on Split Opinions

- Majority Rule: Decision follows the majority opinion within a bench.

- Tie-Breaker: An additional member’s opinion will resolve a split decision.

Revenue Courts and Officers

Section 15: Territorial Divisions

- State Structure → Divisions and districts.

- Districts in Divisions.

- Districts may be divided into sub-divisions, each comprising one or more tehsils.

- Tehsil into Sub-Tehsils.

Officers

- At State Level

- Settlement Commissioner and necessary Additional Settlement Commissioners.

- Director of Land Records and any required Additional/Assistant Directors.

- At Divisional Level

- A Commissioner and necessary Additional Commissioners.

- At District level

- Compulsory Appointments: Each district will have a Collector (also Land Records Officer) and each tehsil will have a Tehsildar.

- Optional Appointments: State may appoint Additional Land Record Officers, Settlement Officers, Assistant Collectors, Naib-Tehsildars, and Additional Collectors/Tehsildars as necessary.

Section 20-A: Revenue Appellate Authority

- Role: State Government may appoint officers (Minimum 3 ) as Revenue Appellate Authorities to handle appeals, revisions, and references in revenue cases.

Section 30: Formation and Alteration of Patwaris’ Circles

- The Director of Land Records, with State Government approval, may arrange villages into Patwaris’ circles and modify these boundaries as necessary.

Section 31: Appointment of Patwaris

- Role of Patwari: Each circle shall have a Patwari appointed by the Collector, responsible for maintaining records, collecting rents/revenues, and performing duties as prescribed by the State Government.

Section 32: Formation and Alteration of Land Records Inspection Circles

- By The Director of Land Records, with State approval.

Section 33: Appointment of Girdawar Qanungos (Land Records Inspectors)

- The Collector appoints a Girdawar Qanungo or Land Record Inspector for each inspection circle to supervise and maintain records.

Section 34: Sadar Qanungos

- The Director of Land Records appoints one or more Sadar Qanungos in each district to oversee Girdawar Qanungos and Patwaris.

Village Servants

Section 41 → Each village/group must have designated servants (e.g., watchman, Balai) as directed by the Collector under State guidelines.

- Appointment: The Tehsildar appoints village servants within six weeks of a vacancy or directive to appoint.

- The Tehsildar maintains a register of all village servants.

- Duties of Village Servants: Village servants’ duties are defined by rules, with village watchmen specifically supervised by the Superintendent of Police.

- Disqualifications for Appointment

- (a) has not attained the age of majority, or

- (b) is not physically or mentally capable of discharging the duties of his office, or

- (c) does not reside in the area for which he is appointed, or

- (d) has been convicted by a criminal court of an offence involving moral turpitude.

Procedure of Revenue Courts and Officers

- Place for Court/Inquiries

- Officers may hold court/inquiries within jurisdictional limits.

- Land Entry & Survey Powers to Authorized officers/servants.

- Representation: Parties may appear personally, via agents, or by legal practitioners.

- Process: Serving of Summons → Notice Service

- Appeal Limits: No appeal from orders unless for valid non-appearance reason (30-day window to apply for order reversal).

- Applications to contest an award must be made within 20 days after notice of award filing.

Appeal, Reference, Revision and Review

- Section 75. First Appeals

- Section 76. Second Appeals

- Section 77. No Appeal in Certain Cases

- From an order admitting an appeal/review on grounds specified in Section 5 of the Indian Limitation Act, 1908.

- From an order rejecting a revision/review application.

- From an order expressly declared as final by this Act.

- From an interim order.

- Section 78. Limitation for Appeals

- No appeal lies after:

- 30 days to the Collector, Land Records Officer, or Settlement Officer.

- 60 days to the Revenue Appellate Authority, Settlement Commissioner, or Director of Land Records.

- 90 days to the Board.

- No appeal lies after:

Land

Section 88: State Ownership of Roads, Land, and Water

- The Collector, with the Commissioner’s approval, may manage these assets.

- Suits challenging the Collector’s decisions must be filed within one year of the final order.

Section 89: State Rights over Minerals, Mines, and Fisheries

- Penalties: Unauthorised extraction incurs penalties, up to ₹50 per ton or a minimum of ₹1,000, imposed by the Collector.

Section 90-A: Use of Agricultural Land for Non-Agricultural Purposes

- Permission Required from the State Government.

- Following an inquiry, the State Government may either grant or refuse permission.

- If permission is granted, the landholder must pay urban assessment, a premium, or both, as set by the State Government.

- Penalties for Unauthorised Use

- Trespasser Status: Unauthorised or condition-violating non-agricultural use leads to trespasser designation and potential ejection under Section 91, with provisions of the Rajasthan Tenancy Act, 1955,

- Alternative: Government may allow continued use with additional penalties.

- Urban Area Restrictions: For land in urban areas, permission is granted only if the non-agricultural use aligns with existing master or development plans.

- Appeal Process: Appeals against authority orders must be filed within 30 days, with resolution typically within 60 days. Appeal decisions are final.

Section 91: Unauthorised Occupation of Land

- Trespasser Definition:

- Any person occupying land without lawful authority is a trespasser and can be evicted by the Tehsildar.

- Forfeiture of Crops and Construction or demolition by the Tehsildar.

- Penalties:

- First Offence: Penalty up to 50 times the annual rent or assessment for the occupied period.

- Subsequent Offences: Penalty and possible commitment to civil prison for up to 3 months.

- Recovery: Penalties are recovered as land revenue.

- Trespassers may appeal against the civil prison order.

- Punishments for Unauthorised Occupation:

- Conviction Penalties:

- Imprisonment (1 month to 3 years) and fine (up to ₹20,000) for failing to vacate after notice.

- Employees failing to prevent trespassing may face imprisonment (up to 1 month) or fine (up to ₹1,000).

- Conviction Penalties:

- Special Provisions:

- Investigation: Must be conducted by a Deputy Superintendent of Police or higher.

- Prior Approval: For prosecution under certain conditions, Collector’s prior approval is required.

Section 94: Forest Growth Management

- State Government Authority: The State Government can create rules to control deforestation and regulate forest resources on land in estates or villages.

- Penalties: Violations of these rules may incur penalties, which a criminal court can impose (up to ₹1,000 or daily penalties if the breach is continuing).

- Courts can direct compensation or apply proceeds from the sale of confiscated timber to benefit forest growth.

- Protection of Forest Land: If violations are significant, the Collector may take over the management of the forest land.

- Prohibited Activities: Without the Collector’spermission, no person can cut or use timber or brushwood from protected forest areas.

- Roadside Trees

- All roadside trees planted or maintained by the State Government or local funds will be owned by the State.

Section 98: The Sub-Divisional Officer may grant land in villages (or towns/cities) for storage of household refuse, manure, and fodder, free of rent or premium.

- The land is provided under conditions:

- Not a right but dependent on availability.

- Collector can resume the land without compensation.

- The grantee cannot transfer the land (e.g., by sale, gift).

- The grantee must follow rules and regulations.

- If the rules are violated, the land can be resumed by a revenue officer of at least the rank of Tehsildar.

Section 101: Allotment of Land for Agricultural Purposes

- Agricultural land is allotted according to rules set by the State Government.

- Priority for allotment is as follows:

- Co-sharers of holdings if the land forms part of a compact block or shares irrigation sources.

- Persons residing in the village with less land.

- Lottery if demand exceeds supply.

- Definition of Land

- “Land” includes land owned by the Government or local authorities, land acquired for public purposes, and Nazul land.

Survey and Record Operations

Section 106: The State Government may declare an area under survey or re-survey.

- The State Government can order a general or partial revision of records in any previously surveyed area, placing it under record operations until further notice.

- Appointment of Land Record Officers (LRO) by the state Govt, to oversee operations

- Operations are supervised by the Director of Land Records.

Section 111: Resolution of Boundary Disputes

- Boundary disputes are resolved by the Land Records Officer, using existing survey maps where possible or based on actual possession.

- In cases of wrongful dispossession within three months, the officer will determine rightful possession through a summary inquiry.

Section 112: The Land Records Officer prepares maps and field books for surveyed areas.

Section 113: Record of Rights

- The Land Records officer creates a record of rights for each village, detailing landholding information.

Section 114: Contents of the Record of Rights

- The record includes:

- A khewat: A register of estate-holders, detailing each one’s interest, co-sharers, mortgagees, and non-tenant landholders.

- A khatauni: A register of land cultivators or occupants, with details as per Section 121.

- Maafi Register: Register of land held free of rent or revenue.

- Additional prescribed registers.

Section 118: Khudkasht Land Determination

- The Land Records Officer determines the extent of khudkasht (self-cultivated) land and records it accordingly.

Section 120: Register of Villages

- The Land Records Officer will prepare a register listing villages in the area under survey or record operations. The register will include:

- Areas subject to fluvial cultivation and precarious cultivation,

- Revenue or rent assessed and collection agents,

- Areas where revenue/rent is partially or fully exempted, along with the authority and conditions.

Section 121: Details in Khatauni (Tenant Register)

- The Khatauni register specifies details for each tenant, including:

- Tenant type, class, and tenure as per the Rajasthan Tenancy Act or other applicable laws,

- Premium paid for khatedari rights, if any,

- Date of khatedari parcha and any transfers made,

- Khasra number of each field, area, annual rent, conditions of tenure,

- For non-khatedar tenants, the duration of land possession,

- Other prescribed details.

- Also lists estate-holders with khudkasht (self-cultivated land) and duration of possession.

Dispute over Rent or Revenue

- In disputes over rent/revenue, the Land Records Officer will record previous year’s amount unless adjusted by decree or agreement.

Section 128: Boundary Disputes

- Boundary disputes are settled by the Land Records Officer per Section 111.

- Applications for boundary clarifications can be submitted to the Tehsildar if there’s no existing dispute but a potential for one.

Section 132: Annual Registers

- The Land Records Officer must maintain a record of rights and annually prepare or amend the registers listed in Section 114. These updated registers are referred to as annual registers.

- All changes or transactions affecting rights or interests must be recorded in the annual registers.

Reporting Succession and Transfer of Possession

- Anyone obtaining possession of land or rights in land (via succession, transfer, etc.) must report the change within 3 months to the Tehsildar. → Up to ₹10 Fine for Failing to Report

- The Tehsildar, upon receiving a report, will inquire about the change. In undisputed cases, the change will be recorded in the annual registers. If there is a dispute, the Tehsildar will decide or refer the matter to a competent authority.

- Inspection of Records: All maps, field books, and registers are open to the public for inspection free of charge.

A-Survey of Abadi Areas

- Section 141: The State Government can order a survey of any abadi area.

- Local authorities may be tasked with conducting the survey, or the district’s Collector may take charge if no authority is assigned.

Boundary Disputes:

- In case of disputes over boundaries during the survey, an Assistant Records Officer will hold an inquiry.

Survey Records:

- After completing the survey, all related maps, registers, and documents are sent to the officer or authority in charge of the survey.

- Any objections can be lodged within two months of the notification, and the authority will address them.

Settlement Operations

Section 142: The State Government can declare any district or local area under settlement or re-settlement operations by notification..

- Criteria for Re-settlement:

- Potential for reasonable revenue increase or decrease.

- Justification for delaying re-settlement if a revenue increase is possible.

- Whether the existing assessment is uneven or too harsh.

- Revenue Increase: A reasonable revenue increase is considered one that can recover the costs of re-settlement within 10 years.

- Appointment of Settlement Officers by the State Government.

- Economic Survey: The Settlement Officer must conduct an economic survey of the condition of the tenants focusing on factors such as:

- Irrigation availability and improvements.

- Cultivation standards and changes in cultivated land.

- Costs of cultivation and livelihoods.

- Market access and communications.

- Size of holdings and tenant indebtedness

- After the economic survey, the Settlement Officer forms assessment circles or groups within the district, considering factors like physical configuration, climate, population, agricultural resources, crop types, and rental rates.

- The Settlement Officer must classify soils within each assessment circle or group.

Section 152: Settlement Officer’s Considerations for Rent-Rates:

- Rent and cess collections over the past 20 years, excluding years deemed abnormal.

- Average agricultural produce prices over the past 20 years, excluding abnormal years.

- Types of crops grown and average yield.

- Value of produce at the average price.

- Cultivation costs and subsistence for cultivators and their families.

- Average fallow land, rotation practices, and rest periods.

- Instances of remissions, suspensions, or short collections.

- Previous settlement rent-rates, share of produce, and commutation prices.

- Rent-rates for similar soil types in nearby areas.

Rent-Rate Share: These rates should not exceed one-sixth of the value of the produce.

Sanction of Proposals

The Settlement Commissioner reviews the Rent proposals and may recommend them to the Board. The Board then submits the proposals to the State Government, which may approve, modify, or return them for reconsideration.

- Exclusions → Certain lands are excluded from rent assessment, such as:

- Buildings and their appearances.

- Permanent threshing floors.

- Burial and cremation grounds, playgrounds.

- Permanent roads and pathways.

- Uncultivable land.

Limits of Enhancement

- Any enhancement of the existing rent cannot exceed 25% of the current rent, and the adjusted rent cannot be lower than 75% of the calculated valuation.

Progressive Enhancement

- If the assessed rent exceeds the allowable limit, the increase is phased in over up to three years.

Special Provisions for Chahi (Well-Irrigated) Holdings

- Rent for Chahi holdings is calculated separately for land cultivated as Chahi, dry land, and fallow land over the past five years at respective rates.

- If land is intentionally left fallow or dry to avoid proper assessment, it will be treated as Chahi.

Preparation and Distribution of Parchas (Rent Assessment Records)

- After assessing rents, the Settlement Officer prepares assessment parchis (records) for all holdings.

Hearing of Objections and Final Rent Determination

- Tenants or landholders can file objections within 30 days. The Settlement Officer hears and resolves objections, then finalises the rent for each holding.

Section 173: Preparation of Dastoor Ganwai

- Village Record (Wajib-ul-arz or Dastoor Ganwai): The Settlement Officer prepares records for each village covering:

- All cesses which are still payable by tenants in addition to rent

- Customs related to rights over village land and resources, irrigation, easements, and administration.

- The record is read out to villagers, and any objections raised during the reading are decided by the Settlement Officer.

Section 174: Presumption of Settlement Entries

- Entries in the Wajib-ul-arz or Dastoor Ganwai are presumed accurate unless proven otherwise.

Section 175: Settlement Term

- Settlements last 20 years, with possible extensions or shorter terms if deemed necessary due to factors like population pressure, reduced cultivation, or land deterioration.

Section 176: Early Termination of Settlement

- The State Government can terminate a settlement before its term ends if:

- There is a significant and material drop in prices.

- There is a major disparity in rent-rates between areas or neighbouring regions.

- The sanctioned rent-rates are found to be inequitable.

- Or for any other sufficient reason.

Partition of Estates

Section 184: Partition

- Partition refers to the division of a partible estate into two or more portions, each consisting of one or more shares.

- Persons Entitled to Claim Partition

- Co-sharers’ Right: Every co-sharer of a partible estate is entitled to claim partition of their share.

- Joint Claims: Any number of co-sharers can join in making the claim.

- To Whom Application Lies → Collector of the district where the estate is situated.

- Multiple Districts → Commissioner (if in the same division) or by the Board (if in different divisions).

- Proclamation of Application for Partition by the Collector.

- Objection Raising Question of Title: If a co-sharer raises an objection about property title, the Collector can:

- Decline to grant the partition, Require a party to file a suit in a competent court within three months or Proceed to inquire into the matter.

- After the inquiry, the Collector will make a preliminary order.

- Who Will Make the Partition

- The Collector may allow the parties to partition the estate themselves or appoint arbitrators for the task.

- If the parties disagree or arbitration fails, the Collector will make the partition directly.

- The Collector will issue a proclamation to all concerned parties, asking them to appear and submit objections within 15 days.

- Final Order for Partition

- Once revenue distribution is complete, the Collector issues a final order specifying:

- Lands allocated to each portion.

- Revenue assessment for each portion.

- Details of co-sharers if the portion is shared, including individual rights and obligations.

- Rights for each co-sharer to gain possession of their allotted portion.

- Once revenue distribution is complete, the Collector issues a final order specifying:

- Instrument of Partition

- The Collector prepares a formal instrument of partition for each divided portion, recording the effective date, generally July 1 following the final order.

Collection of Revenue

Section 224: Revenue or rent assessed on an estate or holding is the primary charge on the land and its produce.

- Responsibility for Revenue

- All holders and co-sharers are jointly and individually liable to the government for the revenue.

- All tenants and co-tenants are similarly liable for rent due to the government.

- Anyone coming into possession of an estate or holding inherits responsibility for any arrears at the time of possession.

Section 228: Processes for Recovery of Arrears

- The Collector can recover arrears by:

- Serving a writ of demand.

- Attaching and selling the defaulter’s movable property.

- Attaching the specific area or share of land in arrears.

- Transferring the share to a solvent

- co-sharer for up to ten years if they cover the arrears.

- If other methods fail, the Collector may auction the Defaulter’s Specific Area, Patti, or Estate to recover arrears.

- Selling other immovable property of the defaulter (excluding Jagir land or landowner estates).

Section 246: The defaulter can apply to set aside the sale within 30 days by depositing:

- 5% of the purchase money.

- The arrears, minus any payments made since the proclamation.

- The cost of the sale.

If the deposit is made, the Collector can set aside the sale.

FAQ (Previous year questions)

The Rajasthan Land Revenue Act, 1956, governs the process of mutation in Rajasthan, which involves updating land records to reflect changes in ownership, possession, or other rights due to events like sale, inheritance, gift, or partition.

Key Provisions Related to Mutation:

Section 135: Report changes in land rights (e.g., sale, inheritance) to the Tehsildar within 6 months.

Section 136: Tehsildar verifies (on receiving a report or on Suo-Moto) and updates the Record of Rights (Jamabandi).

Section 137: Mutation for succession based on legal documents.

Section 138: Disputed cases referred to civil court; temporary records are made until resolved.

Section 139: Updated records in Jamabandi are treated as proof unless challenged in court.

Section 140: Correction of clerical errors by Tehsildar.

Patwari reports changes and updates records post-mutation (Section 33).

Section 114 : Contents of record of rights –

Khewat : a register of all estate-holders in the area under survey and record operations or under record operations, specifying the nature and extent of the interest of each and his co-sharers, mortgages in possession and persons holding land from him otherwise than as tenants, if any;

Khatauni : a register of all persons cultivating or otherwise holding or occupying land in such area, specifying the particulars required by Section 121;

Maafi Register : a register of all persons holding land in such area free of rent or revenue; and such other registers as may be prescribed

As per Section 3 of Rajasthan Land Revenue Act, 1956 : Nazul Land : Refers to abadi (inhabited) land within the limits of a municipality, panchayat circle, village, town, or city that belongs to the State Government.

Section 114 : Record of rights –

Khewat : a register of all estate-holders in the area under survey and record operations or under record operations, specifying the nature and extent of the interest of each and his co-sharers, mortgages in possession and persons holding land from him otherwise than as tenants, if any;

Khatauni : a register of all persons cultivating or otherwise holding or occupying land in such area, specifying the particulars required by Section 121;

Maafi Register : a register of all persons holding land in such area free of rent or revenue; and

such other registers as may be prescribed

Section 132 – the Land Records Officer is responsible for keeping updated land records. To ensure this, he is required to prepare an “annual register” every year, or at such longer intervals as may be prescribed.

Record of Rights – As laid down under Section 114, detailing the legal status of landholders and tenants.

Mutation Register – A record of changes in land ownership or possession due to sale, inheritance, gift, etc.

Cultivation Register – Documents details about the crops grown, the type of land use, and agricultural activities.

Other Prescribed Papers – Any additional documents or registers that may be required under rules or government instructions.

The Annual Register, as defined in Section 132, includes the Record of Rights along with other records like the mutation and cultivation registers. That means it has more information and is used for both legal and revenue purposes. So, it is wider in scope than just the Record of Rights.

As per Section 3 of Rajasthan Land Revenue Act, 1956 : Nazul Land : Refers to abadi (inhabited) land within the limits of a municipality, panchayat circle, village, town, or city that belongs to the State Government.

According to Section 2 under Rajasthan Tenancy Act, 1955 –

Crops – shall include shrubs, bushes, plants and climbers such as rose bushes, plants, mehendi bushes, plantains and papittas, but shall not include fodder and natural produce.

According to Section 2 under Rajasthan Tenancy Act, 1955 –

Crops – shall include shrubs, bushes, plants and climbers such as rose bushes, plants, mehendi bushes, plantains and papittas, but shall not include fodder and natural produce.

Section 5 : Sayar – includes

Any payment made by a lessee or licensee for the right to collect from unoccupied land various products such as grass, thatching grass, wood, fuel, fruits, lac, gum, long, pala, panni, water-nuts, or similar items.

It also covers payments for refuse as bones or dung lying scattered on the surface or on account of fisheries of forest rights or the use of water for irrigation purposes from artificial sources;

Section 5 : “Agriculturist” shall mean a person who by himself or by servants or tenants earns his livelihood wholly or principally by agriculture.

Section 16 : Land in which Khatedari rights shall not accrue:

pasture land;

land used for casual or occasional cultivation in the bed of river or tank;

land covered by water and used for the purpose of growing Singhara or other like produce;

land under shifting or unstable cultivation;

land comprised in gardens owned and maintained by the State Governments;

land acquired or held for a public purpose or a work of public utility;

land which, at the commencement of this Act or at any time thereafter, is set apart for military encampment grounds;

land situated within the limits of cantonment;

land included within railway or canal boundaries;

land within the boundaries of any Government forest;

municipal trenching grounds;

land held or acquired by educational institutions for purposes of instruction in agriculture or for play- ground; and

land within the boundaries of a Government agricultural or grass farm;

land which has been set apart or is, in the opinion of the Collector, necessary for flow of water thereon in to any reservoir or tanka for drinking water for a village or for surrounding villages:

Section 5 : “Trespasser” shall mean a person who takes or retains possession of and without authority or who prevents another person from occupying land duly let out to him.

Primary Rights’ of tenants under the Rajasthan Tenancy Acct, 1955

Rights to residential house— A tenant shall have the right, free of charge, to possess in the abadi of the village in which he holds land a site for a residential house.

Right to written lease and counterparts— Every tenant shall be entitled to receive from his land holder a written lease consistent with the provisions of this Act in the prescribed Form and containing the prescribed particulars.

Attestation of leases in lieu of Registration—The parties to a lease may, in lieu of registering the same, obtain the attestation thereto of such officer or person as the State Government may appoint in this behalf.

Prohibition of premium or Forced Labour—No land holder shall accept a premium for the grant or a lease or make a tenant liable to render any service of the land-holder whether for wages or otherwise and such condition shall be void, notwithstanding any law or custom to the contrary.

Prohibition of payment other than rent— No payment by whatever name called or known, shall in addition to the rent of the holding, or any other charge imposed by law or approved by the- State Government, be levied on or recovered from a tenant.

Use of materials— Tenant shall have the right to remove and utilise for any work in connection with his holding or residential house, stones or other materials lying on, or under the surface of his holding or obtained by digging during the course of making an improvement.