Responsibility and Social Accounting is an important chapter in the subject Accounting & Auditing that highlights the ethical and social obligations of businesses. It focuses on how organizations account for their impact on society and the environment, beyond just financial performance. This approach encourages transparency, sustainability, and corporate accountability.

Previous Year Questions

| Year | Question | Marks |

| 2021 | Mention four types of responsibility centres with reference to Responsibility Accounting. | 2 M |

| 2016 | What do you mean by Social Accounting ? Give any three characteristics of Social Accounting. | 5 M |

| 2016 Special | Write any two limitations of Responsibility Accounting. | 2 M |

| 2016 Special | Write the meaning of responsibility Accounting and the names of responsibility centres. | 5 M |

| 2016 Special | Define Social Accounting. | 2 M |

Social Accounting

The concept of ‘Social Accounting’ has gained importance as a result of high level industrialization which has brought prosperity as well as many problems to the Society.

- Business is a socio-economic activity and it draws its inputs from the society, hence its objective should be the welfare of the society.

- Social accounting aims to measure and inform the general public about the social welfare activities undertaken by the enterprise and their effects on the society.

- Social accounting is concerned with accounting for social cost incurred by the enterprise and the social benefits created.

Definitions:

- The Institute of Chartered Accountants of India or the ICAI defined it as “Social accounting is a way of measuring, understanding, reporting and ultimately improving an organization’s social and ethical performance”.

- The National Association of Accountants (NAA) Committee defined social accounting as “the identification, measurement, monitoring and reporting of the social and economic effects of an institution on society.” We may include environmental effects also.

- Eg: “Go green” by Hero Motocorp (integration of innovative technologies with sustainable practices to address climate change and promote a greener future), “Eco friendly dye” by Jaipur Rugs → These types of non-financial transactions are recorded in social accounting.

Some provisions of social accounting in India

- True blood committee report (1973) on “the objectives of financial statements” emphasized on social accounting.

- Sachar Committee (1978): Recognized the need for social disclosures in India.

- Tata Iron Steel: Pioneered social accounting in India.

- Mandatory CSR: Governed by clause 135 of the Companies Act, 2013

Social Accounting Tools:

- Social Audit

- Public Hearing

- CAMPA

Social cost:

- Social cost refers to the negative effects a business’ activities have on society, which are not directly paid by the business itself.

- These costs are often borne by the community, environment, or society as a whole. For eg. factory releases pollutants into the air, causing health problems for nearby residents.

Objectives of Social Accounting:

- For company: Effective utilization of natural resources.

- For employees: Providing facility of education to children of employees, good working environment conditions.

- For society: Environment conservation, hospitals, parks, etc. It nullified the adverse effect of industrialization.

- For customers: Providing goods at a lower rate with high quality.

- For investors: Providing transparent accounting information.

Features of Social Accounting:

- Social accounting is an expression of a company’s social responsibilities.

- It is related to the use of social resources.

- It emphasizes the relationship between firm and society.

- It determines the desirability of the firm in society.

- It is an application of accounting on social sciences.

- It emphasizes on social costs as well as social benefits.

Benefits of Social Accounting

- Corporate Responsibility – Promotes ethical and transparent business practices.

- Better Policy Formulation – Aids in sustainable development policies and CSR regulations.

- Sustainable Growth – Encourages resource conservation and environmental protection.

- Informed Decision-Making – Helps businesses and investors align with ethical and sustainable values.

- Public Trust & Accountability – Enhances corporate reputation and stakeholder confidence.

- Evaluation of Externalities – Identifies social and environmental impacts for corrective action.

- Ethical Business Growth – Supports long-term sustainability over short-term profits.

Approaches:

- Classical Approach: This accounting approach shows how a business maximizes profits while following legal and ethical rules and acting in society’s best interest.

- Descriptive Approach: In this social activities are disclosed in narrative form along with financial statements.

- Programme Management Approach: In this organisation has to disclose its Social Objectives, how it is going to achieve them, and how the feedback and control have been exercised.

- Integral Welfare Theoretical Approach: accounts for both social benefits and social costs in the financial statements.

- Pictorial Approach: In this approach, photographs of various welfare activities conducted by the organization are presented in annual reports.

How Social Accounting differs from Conventional Accounting System

| Aspect | Conventional Accounting | Social Accounting |

| Primary Function | Measures economic consequences in terms of money. | Determines social consequences in socio-economic and non-monetary terms along with economic effects. |

| Focus | Deals with money-related transactions and financial performance. | Focuses on the impact of business activities on society. |

| Objective | Provides financial information to investors, creditors, and regulators. | Evaluates a company’s impact on society and the environment. |

| Scope | Records income, expenses, assets, and liabilities. | Covers social responsibility, sustainability, and ethical business practices. |

| Stakeholders | Mainly serves investors, creditors, and government authorities. | Includes employees, communities, environmental groups, and society. |

| Performance Monitoring | Develops measurement systems for economic performance. | Develops measurement systems for social performance. |

Limitations of Social Accounting

- Lack of Standardized Framework – No universally accepted guidelines make measurement and comparison difficult.

- Subjectivity in Measurement – Social and environmental impacts are often qualitative, leading to inconsistent evaluation.

- High Cost & Time-Consuming – Data collection, analysis, and reporting require significant resources.

- Limited Awareness & Adoption – Many organizations, especially in developing countries, do not prioritize social accounting.

- Difficulties in Quantifying Social Impact – Intangible benefits like employee well-being and community development are hard to measure in monetary terms.

- Possible Manipulation & Greenwashing – Companies may present misleading reports to enhance their image rather than make real social contributions.

Responsibility Accounting

Responsibility Accounting

- This concept was developed by Professor A.J.E. Sorgdrager.

- Responsibility Accounting is a management accounting system in which an organization is divided into smaller responsibility centers. It is based on the controllability principle, where each center is managed by a designated person who is accountable for its overall performance.

- The performance of each responsibility center is compared with the predetermined targets, and necessary corrective actions are taken in case of any deviations.

- The basic idea is that managing all financial activities together in large and diversified organizations is challenging. Therefore, through decentralization, the organization is divided into smaller, manageable units, improving cost control, budget management, and performance evaluation, ultimately enhancing the organization’s efficiency and accountability.

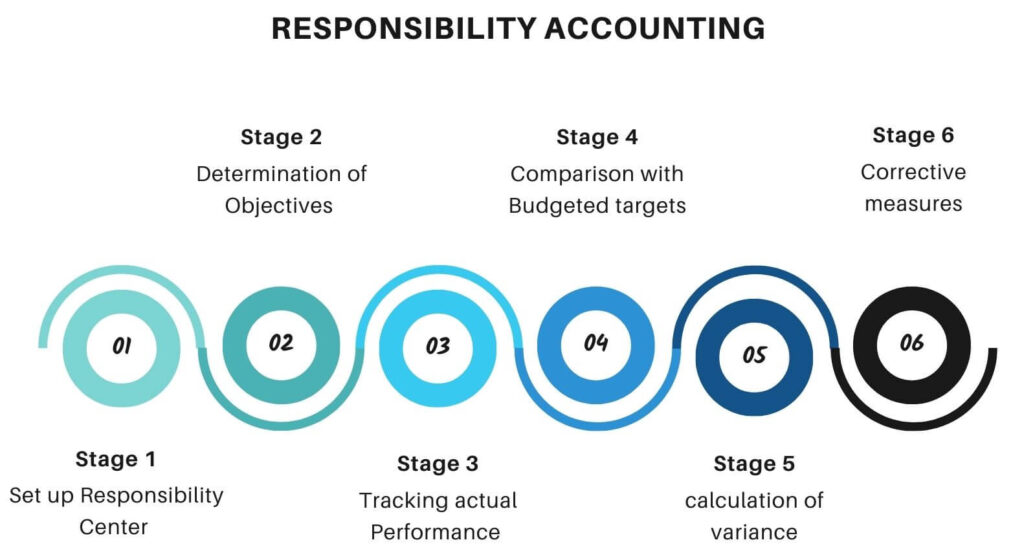

Process:

- Setup responsibility centre

- Determination of objectives of different responsibility centres.

- Tracking and Compare actual performance with the KPIs (Key Performance Indicators).

- Calculate the difference with the standards (KPI).

- Corrective measures for that responsibility centre.

Other definitions

- According to Horngreen, “Responsibility accounting focuses on people and not on things. It is designed to present managers with information relating to their individual fields of responsibility’’.

- Its primary objective is to assist in planning, costing, and managing different departments within a company.

Types of responsibility centers:

| Center | Purpose | Example |

| Cost Centre | Responsible for the cost incurred. | Production department |

| Revenue Center | Responsible for generating revenue. | Marketing department |

| Profit Center | Responsible for both revenues and costs. | Retail store division |

| Investment Centre | Responsible not only for profits but also for investments made in the center in the form of assets. | R&D Division |

- Cost center: Primarily focuses on minimizing expenses.

- Revenue center: Responsible for maximizing sales.

- Profit center: Aims to maximize profit by optimizing revenue and expenses.

- Investment center: Evaluates the profitability of investments.

Essential Features of Responsibility Accounting:

Cost & Revenue-Based System

- Tracks inputs (resources used) and outputs (revenues) in monetary terms.

- Helps in financial control by comparing costs and revenues.

Use of Budgeting

- Compares planned and actual financial data for better control.

- Incorporates fixed and flexible budgets for effective planning.

Responsibility Centers Identification

- Divides the organization into accountable units (departments, divisions).

- Each center is managed by an individual responsible for its performance.

Alignment with Organizational Structure

- Ensures accountability aligns with the existing management structure.

Assigning Costs to Responsible Individuals

- Only assigns controllable costs and revenues to individuals.

- Helps evaluate performance based on actual influence over costs.

Performance Reporting

- Prepares responsibility reports comparing planned vs. actual results.

- Reports flow bottom-up, highlighting deviations for corrective action.

Advantages:

- Performance Evaluation – Helps in rating individual managers based on cost control and operational efficiency.

- Management by Objectives (MBO) – Sets clear targets for managers and holds them accountable.

- Corrective Action – Identifies problem areas and allows quick corrective measures to improve efficiency.

- Delegation of Authority – Encourages decentralization by clearly defining responsibilities.

- High Morale and Efficiency – Employees stay motivated as rewards are linked to performance.

- Simplifies Decision-Making – Clear roles and responsibilities make decisions faster and more effective.

- Management by Exception – Focuses on major deviations from the plan, saving time and effort.

- Profit maximization, cost control.

- Identifies Weak Areas – Helps in recognizing and improving underperforming segments.

Disadvantage:

- Difficult to Define Responsibility Centers – Dividing an organization into clear responsibility units can be complex, especially when departments are interdependent.

- Focus on Short-Term Goals – Managers may prioritize immediate targets instead of long-term business growth.

- Challenges in Assigning Costs and Revenues – Some costs and revenues are shared across departments, making accurate allocation difficult.

- High Pressure on Managers – Too much accountability can cause stress, affecting decision-making and efficiency.

- Prioritise center’s objective over organization’s objective

- Excessive cost (need highly trained management)

- Poor performance of one center affects another.

- Not suitable for a small business.

- Blame Shifting: May lead to blame-shifting when factors beyond a manager’s control affect performance.

- Suitability Limitations: Helpful in the Manufacturing sector only.

FAQ (Previous year questions)

Classical Approach: This accounting approach shows how a business maximizes profits while following legal and ethical rules and acting in society’s best interest.

Descriptive Approach: In this, social activities are disclosed in narrative form along with financial statements.

Programme Management Approach: In this, the organisation has to disclose its Social Objectives, how it is going to achieve them, and how the feedback and control have been exercised.

Integral Welfare Theoretical Approach: This approachaccounts for both social benefits and social costs in the financial statements.

Pictorial Approach: In this approach, photographs of various welfare activities conducted by the organization are presented in annual reports.

Types of responsibility centers with reference to Responsibility Accounting :

Center

Purpose

Example

Cost Centre

Responsible for the cost incurred.

Production department

Revenue Center

Responsible for generating revenue.

Marketing department

Profit Center

Responsible for both revenues and costs.

Retail store division

Investment Centre

Responsible not only for profits but also for investments made in the center in the form of assets.

R&D Division

Social accounting is concerned with accounting for social costs incurred by the enterprise and the social benefits created.

The National Association of Accountants (NAA) Committee defined social accounting as “the identification, measurement, monitoring and reporting of the social and economic effects of an institution on society.”

Eg: “Go green” by Hero Motocorp (integration of innovative technologies with sustainable practices to address climate change and promote a greener future), “Eco friendly dye” by Jaipur Rugs → These types of non-financial transactions are recorded in social accounting.

Characteristics of Social Accounting: Social accounting is an expression of a company’s social responsibilities.

It is related to the use of social resources.

It emphasizes the relationship between firm and society.

It determines the desirability of the firm in society(It helps in measuring how desirable or harmful a company is to the society.)

It is an application of accounting on social sciences.

It emphasizes on social costs as well as social benefits.

Difficult to Define Responsibility Centers

High Pressure on Managers

More effective in the manufacturing sector than in other industries

Challenges in Assigning Costs and Revenues

Focus on Short-Term Goals

Prioritization of Center’s Objective Over Organizational Goals

The failure of one center can negatively affect others

Requires highly trained management, leading to higher costs

Not Suitable for Small Businesses

Responsibility Accounting is a management accounting system in which an organization is divided into smaller responsibility centers. It is based on the controllability principle, where each center is managed by a designated person who is accountable for its overall performance.

The performance of each responsibility center is compared with the predetermined targets, and necessary corrective actions are taken in case of any deviations.

Types of responsibility centers with reference to Responsibility Accounting :

Center

Purpose

Example

Cost Centre

Responsible for the cost incurred.

Production department

Revenue Center

Responsible for generating revenue.

Marketing department

Profit Center

Responsible for both revenues and costs.

Retail store division

Investment Centre

Responsible not only for profits but also for investments made in the center in the form of assets.

R&D Division

Social accounting is concerned with accounting for social cost incurred by the enterprise and the social benefits created.

The Institute of Chartered Accountants of India or the ICAI defined it as “Social accounting is a way of measuring, understanding, reporting and ultimately improving an organization’s social and ethical performance”.

The National Association of Accountants (NAA) Committee defined social accounting as “the identification, measurement, monitoring and reporting of the social and economic effects of an institution on society.”