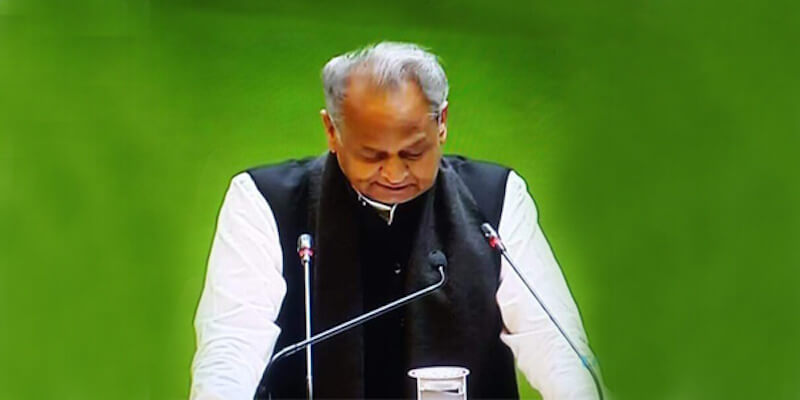

Rajasthan Budget 2021 was presented by Rajasthan Chief Minister Shri Ashok Gehlot, who is also the state finance minister, today in State Legislative Assembly. Like the Union Budget 2021, the Rajasthan Budget 2021 is also paperless this time. The Rajasthan Budget 2021 highlights are presented below:

- After Uttar Pradesh, Rajasthan is the second state in the country to table a paperless budget.

Fiscal Indicators

- Estimated revenue receipts 1 lac 84 thousand 330 crore 13 lac

- Estimated revenue expenditure 2 lac 8 thousand 80 crore 17 lac

- Estimated revenue deficit 23 thousand 750 crore 4 lac

- Estimated fiscal deficit 47 thousand 652 crore 77 lac which is 3.98% of GSDP.

Corona Management:

- Special Covid Package

- 2000 each to 33 lakh destitute families.

- Indira Gandhi Urban Credit Card Scheme

- Interest free loan up to 50,000

- मुख्यमंत्री लघु प्रोत्साहन योजना – 50 Crore Interest Subsidy to 10,000 entrepreneurs.

- Seed money to start-ups, 5 lac each.

- Back to School Programme, Free uniform and text books, 470 Cr.

- 200 days employement to Shahariya, Kathodi and Specially abled labourers.

Medical and health :

- “Rajasthan Model of Public Health’ (RMPH).

- ‘Universal Health Coverage’ – 5 lac health insurance to each family.

- Nursing colleges at 25 district headquarters.

- Public health colleges at divisional headquarters.

- Increase in number of tests under – मुख्यमंत्री निशुल्क जांच योजना

- Construction of hospital buildings and increase in various facilities including beds.

- 30 new PHCs and upgrading of 50 PHCS to CHCS.

- Upgrading hospitals as district hospitals, 10 new trauma centres.

- Construction of buildings for 40 CHCs and 25 PHCs with expenditure of 206 Cr.

- New district hospitals at Kota with 150 beds.

- Increase of 1000 beds in different hospitals.

- 12,000 Health and Wellness Centres.

- राजस्थान राज्य आयुष अनुसन्धान केंद्र at Ajmer.

- Model CHCs in each assembly constituency.

- Increase in beds in district hospitals at Paota, Jodhpur and development of infrastructure with 25.80 Cr.

- New ICU and NICU at medical colleges and new ICU at district hospitals.

- Institute of Tropical Medicine and Virology and Institute of Cardiology at Jaipur.

- Increase of medical facilities at SMS Medical College, Jaipur.

- “Umaid Post Graduate Institute of Maternity and Neonatology’ and ‘Regional Cancer Institute’ at Jodhpur.

- 22 Advance Life Support (ALS) critical care ambulances.

- Ayurved, Unani, Homeopathic hospitals at 58 block headquarters.

- Yog and Naturopathy colleges at Udaipur and Jodhpur.

- International Centre of Excellence in Panchkarm at Jodhpur.

- Post MBBS Diploma Courses in 8 specialities at all district hospitals.

- Separate cadre for specialist doctors and new Hospital Management Cadre.

- Directorate of Food Safety

Road Safety :

- New Jeevan Rakshak Yojana.

- Integrated Traffic Management System (ITMS)

- Primary Trauma Centre at 40 CHCS.

- 100 Cr. for Dedicated Road Safety Fund.

- New DTO and Sub DTO offices.

Education :

- Smart TVs and set-top boxes in schools, 82 Cr.

- 1200 new English medium-Mahatma Gandhi Schools in next 2 years.

- Increase in infrastructure facilities in schools, 450 Cr.

- Directorate of Peace and Non-Violence Mahatma Gandhi Institute of Governance and Social Sciences-MGIGSS at Jaipur.

- Fintech Digital University at Jodhpur.

- Rajasthan Institute of Advanced Learning at Jaipur.

- New colleges including girls-Sanskrit colleges and new ITIS.

- 4 new girls colleges in the name of Late MLAs Master Bhanwar Lal, Shri Kailash Trivedi, Smt. Kiran Maheshwari and Shri Gajendra Singh Shaktawat.

- Rajiv Gandhi Centre of Advance Technology (R-CAT) at Jaipur, 200 Cr.

- Vidya Sambal scheme for Guest Faculty.

- Science & Space Clubs in 1500 government schools.

Youth and Employment:

- Internship for unemployed youth under Mukhyamantri Yuva Sambal Yojana 2019, hike of 1000 in allowance.

- Constitution of Rajeev Gandhi Yuva Core, 2500 Rajeev Gandhi Yuva Mitra and 50000 Rajeev Gandhi Yuva Volunteers.

- Common Eligibility Test, one-time verification system.

- Free travel in Rajasthan Roadways for exams.

- Recruitment on more than 50,000 posts in next 2 years.

- Major Dhayanchand Stadium Scheme.

- Sports stadium on Moroli-Bharatpur and sports facilities at Kachwa-Sikar.

- Multipurpose Indoor hallat Ajmer, Bharatpur, Bikaner and Kota.

- Indoor stadium at Pratapgarh and Stadium at Rajasmand and Sirohi.

- Gram Panchayat, Block, District and State level Popular games tournaments, expenditure of 30 Cr.

- 2 new Residential Sports Schools at Jodhpur and Jaipur.

- Developmental works at Barakatullah Khan Cricket Stadium, Jodhpur, 20 Cr.

- New archery academy at Dungarpur and Handball academy at Jaisalmer.

Agriculture and Animal Husbandry :

- Agriculture Budget from next year.

- Loan of 16000 Cr, under – ब्याज मुक्त फसली ऋण योजना – inclusion of 3 lac new beneficiaries.

- मुख्यमंत्री कृषक साथी योजना – Free bio fertilizers and bio agents to 3 lac farmers, ‘micro nutrients kit’ to 3 lac farmers, high quality seeds to 5 lac farmers.

- Minifood park in each district, 200 Cr.

- Mega food park at Mathania – Jodhpur, 100 Cr.

- ज्योतिबा फुले कृषि उपज मंडी at Anganwa – Jodhpur, 60 Cr.

- 1000 Kisan Sewa Kendra,

- 1000 new posts of agriculture supervisors.

- Provision of more than 16000 Cr. for agriculture electricity subsidy.

- New Agri-Discom.

- 50,000 Solar pumps and 50,000 agriculture electricity connection to the farmers.

- Works of 1000 Cr at Krishi Upaj Mandis. Kisan Complex at Jodhpur, 20 Cr.

- 3 new agriculture colleges at Dugarpur, Hindauli, Hanumangarh.

- 1000 Custom Hiring Centers, 20 Cr.

- 102 – mobile veterinary service, 48 Cr.

- Extension of veterinary facilities, upgradation of veterinary hospitals.

- Formation of राजस्थान पशु चिकित्सा रिलीफ सोसायटी at each veterinary hospitals.

- State level पशुपालक सम्मान समारोह

- 111 Cr. for Nandi Shaalas.

Industries :

- New MSME policy. Industrial areas at 64 sub divisions.

- “Greater Bhiwadi Industrial Township’, 1000 Cr. investment.

- New ‘Marwar Industrial Cluster’, 750 Cr.

- Organising Rajasthan Investors Summit at Jaipur.

- Fintech Park (Financial Technology) at Jaipur

- Biotech-Pharma Business Incubation & Research Centre at Jodhpur.

- Rural i-Start Programme at large scale

Social Security:

- Announcement of Rajasthan Pattern.

- Rajasthan Scheduled Caste and Scheduled Tribe Development Law

- ‘मुख्यमंत्री अनुप्रति कोचिंग योजना’

- Ambedkar DBT Voucher Scheme, 5000 Beneficiaries.

- 8 New Ekalavya Model Residential Schools.

- Construction of 7 Ambedkar Hostels, 28.50 Cr.

- Construction of 8 Minority boys hostels.

- Construction of 3 Minority Girls Residential Schools.

- Minority boys hostels at Jaipur, Jodhpur and Kota.

- SC, ST, OBC, Minority Development Funds, 100 Cr. each.

- 200 Cr. package under Devnarayan Scheme, 3 MBC hostels

- De-notified Tribes (DNT) Policy.

- Increase in scholarship of special abled students.

- 2000 Scooty for for specially abled students and youths.

- Integrated Child Rehabilitation Centres at divisional headquarters.

- Goradhaay Group Foster Care at district headquarters.

- Inclusion of 25,000 Anganbaries in Nand Ghar Scheme.

- Distribution of Sanitary napkins to women, 200 Cr.

- इंदिरा महिला शक्ति केंद्र at district headquarters, 15 Cr.

- 250 Maa-bari Centres in tribal areas.

- 150 Van-dhan centres.

- Increase in allowance from 3000 to 5000 for Martyr’s widows and parents.

- Increase in pension of freedom fighters from 25,000 to 50,000.

- Increase in honorarium of Pujaris of Devasthan Department.

Infrastructure Development:

- Roads – Urban Development:

- New State Road Policy -2021.

- Works of missing link roads and non patchable roads in each constituency, 1000 Cr.

- Upgradation of 7257 KM roads in all districts.

- Major repair works of 3 prominent roads in each district, 1900 Cr.

- Major repair works of roads in Nagar Nigam, Nagar Parishad and Nagar Palika areas.

- Expenditure of 1425 Cr. on 2841 KM rural roads in next two years.

- Development of 27 state highways, 3880 Cr.

- Construction of 8 ROBS, 403 Cr. DPR of 8 ROBS.

- High level bridge in Bundi district, 37.50 Cr.

- DPR of High level bridge in Kota district.

- Construction of 3000 houses by RHB.

- Construction of bridge at Beneshwar Dham, Dungarpur, 132.35 Cr.

- Constitutional Club at Jaipur.

- Developmental works of 700 Cr. in Jaipur city.

- Master Drainage System for Bharatpur, 200 Cr.

- Various construction and developmental works at Kota, Jodhpur, Bikaner, Pali, Alwar and Udaipur.

- Auditorium and Cultural Centre at Jodhpur, 60 Cr.

- Townhalls at Dausa, Jalore, Banswara, Pratapgarh, Sikar and Bundi. Relaunch of Gramin Bus Service.

PHED-WRD:

- 12 new major drinking water projects under JM, 4700 Cr.

- Starting of 6 new projects worth 2285 Cr. under JJM.

- Drinking water connections to 20 lac households under JM.

- DPR for 22 projects under JM. Provisions of 476 Cr. for various drinking water supply schemes.

- Chambal-Bhilwara drinking water project, 1032 Cr.

- Nokha-Bikaner drinking water project, 750 Cr.

- Providing drinking water from Kumbharam lift, 7700 Cr. 40 hand-pumps and 10 tubewells in each constituency.

- 76 Cr. for drinking water schemes in 10 residential colonies of Jodhpur.

- Works of Eastern Rajasthan Canal Project (ERCP), 320 Cr.

- Provision of 885 Cr. for Parvan major irrigation project.

- Rajasthan Water Sector Livelihood Improvement Project-RWSLIP, 465 Cr., 21 districts.

- Rajasthan Water Sector Restructuring Project for Desert Area- RWSRPD, 378 Cr.

- Repair, Renovation, Restoration (RRR) Scheme, works of 124.71 Cr.

Energy:

- Energy Policy 2021-2050

- Green Corridor of 6.3 Gigawatts by RRVPN.

Forest and Environment :

- Campaign for 44196 सामुदायिक वन अधिकार पट्टे.

- Development of Keoladeo National Park as Wetland Birds Habitat Conservation Centre.

- Wildlife Management Training Centre at Talchapar Sanctuary, Churu.

- Kailash Sankhla Smriti Van at Jodhpur.

- FSTPs in 50 towns of 24 districts, < 200 Cr.

- Sewerage Treatment Plants in various hospitals, 25 Cr.

Tourism, Art and Culture :

- Provision of 500 Cr. in Tourism Development Fund.

- Shekhawati Tourist Circuit.

- Godawad Tourist Circuit.

- Renovation of 7 RTDC midways, 10 Cr.

- Religious Tourist Circuits, 100 Cr.

- Tourist Complex at Pushkar – Ajmer

- DPR for Dholamaru Tourism Complex at Jaisalmer, Rajasthan Folk Art Training Institute.

- 15 Cr. provision for Kalakar Kalyan Kosh

- Film Tourism Promotion Scheme.

- Organising Rajasthan Utsav on Rajasthan Day.

- Nehru Youth Cultural Exposure Programme for 5000 youths, artists and players.

Law and Order :

- Inter-operable Criminal Justice System (ICJS).

- New additional SP, Dy. SP, ACP offices

- Upgradation of Police Chowkis in police stations, 25 new police chowkis.

- 3 new police stations under Jaipur Commissionarate.

- Rajasthan Police Infrastructure Development Corporation Infrastucture facilities in various Jails, 31.50 Cr.

- Digital Voice Logger in ACB.

- 40 various new courts in the State.

Good Governance :

- Constitution of Social & Performance Audit Authority

- New ADM, SDM, Tehsil, Sub-Tehsil offices.

- Mini secretariat at Sirohi.

- 6 new municipalities Lateral entry for Ex-service man, 5000 beneficiaries

- प्रशासन गांवो के संग and प्रशासन शहरों के संग campaign

- कार्मिक कल्याण कोष of 3000 Cr.

- 10 Cr. Assistance to Bar Council of Rajasthan.

- Announcement of Rajasthan Government Health Scheme (RGHS)

- Release of deferred salary of corona period to employees.

- Service rules for contractual employees, department wise cadre

- Modern Auditorium at HCM RIPA, Jaipur, 25 Cr.

Tax Proposals

Covid- 19 has adversely affected all sectors of economic activity such as Industry, Real Estate, Tourism, Commerce, Agriculture etc. This resulted into shortfall of 32% of Budgeted revenue of the State in 2020-21. To add to this problem, Rajasthan’s share in Central Taxes reduced by 14,000 Crores and 94 lac rupees in 2020-21. In spite of this, no new tax is being levied. Efforts are made to provide relief to the tune of approximately 910 Cr. rupees to all sections of the society – Common Man, Farmers, Industrialists, Real Estate players, Traders and Tour operators etc.

1. Common Man

- 50% rebate on additional One Time Tax on used 2-wheelers and cars.

- SGST reimbursement to purchasers of e-Vehicles and up-front purchase assistance to buyers of 2-wheeler and 3-wheeler e-Vehicles.

- Stamp duty on the basis of allotment value instead of DLC rate in respect of Pattas given by Local Bodies.

- Stamp Duty on intermediate documents executed after 14th July, 2014 will be charged @ 40% of DLC.

- Stamp duty on gift deed in favour of daughters-in-law will be reduced from 2.5% to 1% in the same lines as daughters.

- The Stamp duty rebate on release deed is extended to more relatives. • No Stamp Duty on Gift deed in favour of grandsons and granddaughters by their grandparents.

- “Late Sh. Gurusharan Chabra Jan Jagrukta Abhiyan” for awareness on temperance and drug abuse. Rs. 100 Cr.

- Nav Jeevan Kosh for rehabilitation of families involved in illicit liquor making and education of their children.

- Simplification and online system for various services such as Transport permit and Tax Clearance Certificate, Electricity Duty, refund of Stamp Duty & Registration Fee and Gypsum leases etc.

- Limit of maximum stamp duty will be 25 Lakhs Rupees in case of Security Bond.

- Amnesty Scheme from 1April, 2021 for pending Stamp Duty cases related to bank loans.

2. Farmers

- Reduction of Mandi Fee, Krishak Kalyan Fee and brokerage to give relief to farmers.

- 10 % rebate on principal amount and 100 % interest in respect of all pending instalments of allottees of agriculture land in Colonisation Areas if a farmer deposits all his pending dues by 30 June, 2021. If he deposits only pending dues up to 30 June, 2021 he will get 100 % rebate in interest.

3. Industry

- Extension of RIPS-2014 benefits by 2 more years till 31 March, 2023.

- Amnesty on interest and penalty on pending Land Tax till 30 June, 2021.

- Inclusion of Gems and Jewellery Bourse in Service Sector of RIPS-2019.

- Inclusion of Healthcare Sector and API in Thrust Sector of RIPS-2019.

- Enhancement of employment subsidy from 75% to 90% for Solar and Wind

- Manufacturing Enterprises under RIPS-2019.

- Lowering of investment limit from Rs. 50 Cr. to Rs. 25 Cr. for e-Vehicle manufacturers for RIPS-2019 benefits.

- Inclusion of e-Vehicles charging/swapping stations in Service Sector with Thrust Sector benefits in RIPS-2019.

4. SC/ST Enterprises

- Dr. B.R. Ambedkar SC/ST Enterprises Promotion Special Package under RIPS-2019.

- SC/ST enterprises will get special benefits such as 50% reduction in investment limit, 200% EFCI, Interest Subsidy or Capital Subsidy and Incubation Centres to promote SC/ST entrepreneurs.

5. Most Backward/ Backward and Tribal Areas Enterprises

- Special benefits on the lines of Dr. B.R. Ambedkar SC/ST Enterprises Promotion Special Package under RIPS-2019 such as 50% reduction in investment limit, 200% EFCI, Interest Subsidy or Capital Subsidy.

6. Real Estate

- Reduction of DLC rates of Commercial and Residential properties by 10%.

- Reduction of Stamp duty from 6% to 4% on flats in multi-storied buildings of value up to Rs. 50 lakh.

- Reduction of Stamp duty on EWS and LIG under CM Jan Awas Yojna from 1% and 2% to 0.50% and 1 respectively.

- Anywhere online registration, fixing of DLC rates by technology, GIS based urban development tax (UD Tax) system.

7. Traders

- A Comprehensive, online and faceless Amnesty Scheme-2021 with exemptions of tax, interest and penalty on various pending disputes related to various repealed Acts such as Sales Tax, VAT, Entry Tax, Entertainment Tax and Luxury Tax. Partial relief in tax for first the time in the State. No monetary ceiling. Valid up to 30 September, 2021. This will be in three phases, early applicants will get more relief.

- Enhancement of limit of e-way bill from Rs. 50,000 to Rs. 1 lakh.

- Extension of time limit for rectification of faulty declaration forms/submission of declaration forms.

8. Transporters

- Transport Amnesty Scheme-2021 till 31″ March, 2021 to give relief in pending Motor Vehicle Tax cases. Relaxation in Compounding fee for overloading cases generated by e-Ravanna and reduction of Compounding fee in respect of select traffic offences. Relaxation in tax, interest penalty on destroyed vehicles.

- 3 years exemption in Motor Vehicle tax for running newly purchased buses in rural areas.

- 8 slab progressive Motor Vehicle Tax for stage carriage vehicles in other routes.

9. Tourism and Tour operators

- Reduction of minimum area of Resort and Amusement Park defined under RIPS-2019 as per Building Bye Laws.

- 100% exemption of monthly tax on AC luxury buses of Tour Operators recognized by IATO and RATO for the period from 1 July 2020 to 30 June 2021. 10.

10. Mining lease Holders

- Involvement of private players in exploration of minor minerals.

- Registered agreement holder in respect of Khatedari land will be entitled to get mining lease.

11. Non-Profit Social Institutions

- Social Security Investment Promotion Scheme: SSIPS-2021 will be launched to give various benefits to non-profit social institutions such as rebate in Stamp Duty, Conversion Charges, Motor Vehicle Tax, etc. A customized package will be given in special cases. No stamp duty will be charged on gift deeds by individual/institutions in favour of these institutions.