Crypto Currency In the subject Technology, the topic Crypto Currency refers to a digital or virtual form of money that uses cryptography for security. It operates on decentralized systems like blockchain, making transactions fast, transparent, and secure.

Definition: A cryptocurrency is a digital or virtual form of currency that uses cryptographic techniques for security. Unlike traditional currencies issued by governments (fiat currency), cryptocurrencies operate on decentralized networks (distributed ledger) using blockchain technology.

Examples of Popular Cryptocurrencies

- Bitcoin (BTC): The first cryptocurrency, introduced in 2008.

- Ethereum (ETH): Known for its smart contract capabilities.

- Ripple (XRP): Focuses on cross-border payments.

Key Features of Crypto Currency

| Feature | Description |

| Decentralization | Operates on decentralized networks, usually using blockchain technology, without central authority. |

| Anonymity & Privacy | Transactions provide a certain level of anonymity; users are identified by wallet addresses. |

| Transparency | Blockchain records all transactions publicly, ensuring transparency and immutability. |

| Security | Cryptographic methods secure transactions, making them tamper-proof and resistant to fraud. |

| Global Accessibility | Cryptocurrencies can be used and traded globally without currency exchange restrictions. |

| Irreversible Transactions | Once a transaction is completed, it cannot be reversed or altered, ensuring accountability. |

| Limited Supply | Most cryptocurrencies (e.g., Bitcoin) have a fixed supply, ensuring scarcity and value retention. |

| Peer-to-Peer Transactions | Direct exchange of value between users without intermediaries like banks. |

| Fast Transactions | Transactions, especially across borders, are processed faster compared to traditional banking. |

| Low Transaction Costs | Minimal fees compared to traditional financial systems, especially for cross-border transfers. |

| Programmable | Many cryptocurrencies, like Ethereum, support smart contracts for automated and secure transactions. |

| Digital Ownership | Users have full control over their cryptocurrency through private keys, ensuring true ownership. |

| No Intrinsic Value | Cryptocurrencies lack inherent value and are not backed by physical assets, relying solely on market trust and demand. |

History and Evolution of Cryptocurrency

- 1980s-1990s: Early Concepts

- Cryptographic Advances: Development of cryptographic protocols (e.g., RSA) laid the foundation for secure digital transactions.

- DigiCash (1989): David Chaum introduced the idea of anonymous digital money but it failed to gain adoption.

- 1998 – Bit Gold: Proposed by Nick Szabo.

- 2008: Bitcoin Whitepaper

- Satoshi Nakamoto published the Bitcoin whitepaper titled “Bitcoin: A Peer-to-Peer Electronic Cash System.”

- Proposed the first decentralized cryptocurrency using blockchain technology.

- 2009: Bitcoin Launch

- The first Bitcoin block, called the Genesis Block, was mined on January 3, 2009.

- First Transaction: Satoshi Nakamoto sent 10 BTC to Hal Finney.

- 2015: Ethereum and Smart Contracts

- Ethereum was introduced by Vitalik Buterin, enabling smart contracts and decentralized applications (dApps).

- Revolutionized cryptocurrency by expanding use cases beyond digital money.

- 2017: Crypto Boom

- Bitcoin reached $20,000 for the first time.

- 2020-Present: Institutional Adoption

- Companies like Tesla, PayPal, and Visa integrated cryptocurrency payments.

- Governments (e.g., India, China) began exploring Central Bank Digital Currencies (CBDCs).

- 2023+: Web 3.0 Integration

- Cryptocurrencies are powering Web 3.0 technologies, including Decentralized Finance (DeFi), Non-Fungible Tokens (NFTs), and Metaverse applications.

How Cryptocurrency Works

Core Technology: Blockchain

- Definition: A blockchain is a decentralized, distributed ledger that records all cryptocurrency transactions across multiple computers.

Key Components

- Blockchain: A distributed ledger that records all transactions across a network of computers.

- Structure

- Blocks: Units of data containing transaction records.

- Chains: Blocks linked sequentially to form a chain.

- Nodes: Individual computers in the network that store and validate blockchain data.

- Immutable Ledger: Once data is added to the blockchain, it cannot be altered, ensuring transparency and security.

- Cryptography: Ensures secure transactions and user anonymity through techniques like hashing and digital signatures.

- Public Key: A unique address for receiving funds (like an account number).

- Private Key: A secret code used to access and authorize transactions (like a password).

- Wallets: Digital tools (software or hardware) that store public and private keys for sending, receiving, and managing cryptocurrency.

- Mining: Transaction Validation

- What is Mining ? : The process by which transactions are verified and added to the blockchain by solving complex cryptographic puzzles.

- Purpose:

- Validates transactions.

- Prevents double-spending.

- Rewards miners with new cryptocurrency (e.g., Bitcoin).

- Proof-of-Work (PoW): Common mining method requiring computational power.

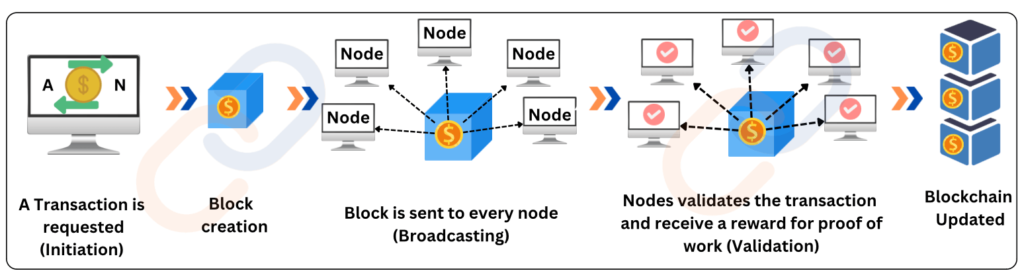

How Transactions Work

- Initiation: A user sends cryptocurrency using their private key to another user’s public key.

- Broadcasting: The transaction is sent to the network.

- Validation: Miners or validators verify the transaction’s authenticity.

- Inclusion in a Block: Verified transaction is added to a block.

- Blockchain Update: Once a transaction is recorded on the blockchain, it is immutable and irreversible.

Consensus Mechanisms

- Proof of Work (PoW): Miners solve complex mathematical problems to validate transactions (used in Bitcoin).

- Proof of Stake (PoS): Validators are chosen based on the number of coins they hold (used in Ethereum 2.0).

- Other Mechanisms: Delegated Proof of Stake (DPoS), Proof of Authority (PoA), etc.

Decentralization

- No single entity controls the network.

- Transactions are validated by multiple nodes, ensuring transparency and trust.

Popular Cryptocurrencies

A. Bitcoin (BTC)

- Introduced in 2008 by “Satoshi Nakamoto.”

- The first cryptocurrency and most widely recognized.

- Purpose: Peer-to-peer digital cash system.

- Characteristics:

- Limited supply: 21 million bitcoins.

- Uses Proof-of-Work (PoW) mining for transaction validation.

B. Ethereum (ETH)

- Introduced in 2015 by Vitalik Buterin.

- Not just a cryptocurrency but a platform for creating decentralized applications (DApps).

- Unique Feature:

- Smart Contracts: Self-executing contracts with predefined rules written in code.

- Decentralized Applications (dApps): Applications that run on Ethereum’s decentralized network.

- Programmable Blockchain: Allows developers to create tokens, NFTs, and complex financial instruments.

- Ether (ETH): The Cryptocurrency

- Uses:

- Decentralized Finance (DeFi), NFTs, Gaming and Metaverse, Supply Chain Management and token creation.

- Ethereum 2.0 Transition from Proof of Work (PoW) to Proof of Stake (PoS) consensus mechanism in September 2022.

- Benefits of PoS:

- 99% reduction in energy consumption.

- Enhanced scalability, security, and sustainability.

- Sharding: Future upgrade to improve transaction speed and reduce costs by splitting the blockchain into smaller parts (shards).

C. Altcoins

- Definition: Cryptocurrencies other than Bitcoin.

- Examples: Litecoin (LTC), Ripple (XRP).

D. Stablecoins

- Definition: Cryptocurrencies designed to minimize volatility by pegging their value to stable assets like fiat currency or gold.

- Examples:

- Tether (USDT): Pegged to the US Dollar.

- Dai (DAI): A decentralized stablecoin pegged to USD.

E. Central Bank Digital Currency (CBDC)

- Definition: Digital currency issued and regulated by central banks as an alternative to cryptocurrencies.

- Example: The Reserve Bank of India (RBI) launched the Digital Rupee (e₹) in 2022 as part of a pilot project.

- Purpose: Combines blockchain benefits with government control.

Non-Fungible Tokens (NFTs)

What are NFTs?

- Non-Fungible Tokens (NFTs) are a type of digital asset that represent ownership or proof of authenticity of a unique item or piece of content on a blockchain.

- Unlike cryptocurrencies (like Bitcoin or Ethereum), which are fungible (interchangeable), each NFT is unique or one-of-a-kind, making it non-fungible.

Key Features of NFTs:

- Unique: Each NFT is distinct, often linked to a specific piece of digital or physical content, such as artwork, music, videos, collectibles, or even tweets.

- Indivisible: They are bought, sold, and owned as whole units.

- Ownership and Provenance: Ownership is recorded on the blockchain, ensuring the authenticity and history (provenance) of the asset.

How NFTs Work:

- NFTs are created through a process called minting. This process involves turning digital files (like images, videos, music, etc.) into NFTs by recording them on a blockchain.

- Most NFTs are minted on the Ethereum blockchain, but other blockchains like Binance Smart Chain, Solana, and Flow also support NFTs.

- Smart contracts on the blockchain govern the sale, transfer, and ownership of NFTs. These contracts can include additional features like royalties for the creator upon resale.

Advantages of NFTs:

- Empowerment of Creators (artists, musicians, developers) to monetize their work directly, without intermediaries.

- Ownership and Provenance: Blockchain ensures the ownership history of the asset.

- Royalties for Creators whenever their work is resold.

Challenges and Criticisms of NFTs:

- Environmental Impact

- Market Speculation

- Copyright Issues: Since NFTs represent ownership, there have been cases where artists’ works were tokenized without their consent, leading to potential copyright infringement issues.

- Scams and Fraud: fake NFT listings, plagiarism.

Applications of Cryptocurrencies

| Application | Description | Examples |

Finance and Banking | Digital Payments: Cryptocurrencies enable fast, secure, and low-cost cross-border payments without intermediaries. | Bitcoin (BTC), Litecoin (LTC) |

| Remittances: Enables individuals to send money across borders without high fees or delays, especially in underbanked regions. | Ripple (XRP), Stellar (XLM) | |

| Decentralized Finance (DeFi): Cryptocurrency-based financial services like lending, borrowing, and trading without traditional banks or brokers. | Uniswap (UNI), Aave (AAVE), Compound (COMP) | |

| Alternative Investment Asset:Cryptocurrencies like Bitcoin and Ethereum are increasingly seen as long-term investments.Many investors buy crypto as a hedge against inflation or traditional market volatility. | Platforms like ZebPay and CoinDCX offer trading services. | |

| Smart Contracts | Self-executing contracts with the terms directly written into code, automating agreements. | Ethereum (ETH), Cardano (ADA) |

| Non-Fungible Tokens (NFTs) | Digital assets representing ownership of unique items like art, music, or collectibles. | Ethereum (ETH), Flow (FLOW) |

| Crowdfunding & ICOs | Cryptocurrencies enable Initial Coin Offerings (ICOs) and token sales to raise funds for new projects or startups. | Ethereum (ETH), Binance Coin (BNB) |

| Gaming & Virtual Goods | Cryptocurrencies are used to buy in-game items, skins, and assets in virtual worlds or games. | Enjin Coin (ENJ), Decentraland (MANA) |

| Supply Chain Management | Transparency and Tracking: Blockchain ensures traceability of goods from production to delivery.Anti-Counterfeiting:Cryptocurrencies support blockchain systems that verify product authenticity.Example: Walmart tracks food supply using blockchain technology. | VeChain (VET), Waltonchain (WTC) |

| Privacy & Anonymity | Privacy coins offer anonymous transactions, protecting users’ financial privacy. | Monero (XMR), Zcash (ZEC) |

| Governance | Cryptocurrency tokens are used to vote on decisions and protocol upgrades within decentralized projects. | Uniswap (UNI), MakerDAO (MKR) |

| Real Estate | Cryptocurrencies enable property transactions by tokenizing real estate assets, simplifying cross-border transfers. | Propy (PRO), RealT |

| Digital Identity | Blockchain-based identity management systems that offer secure, decentralized control over personal data. | SelfKey (KEY), Civic (CVC) |

Blockchain in Social Sectors:

1. Managing Critical Citizen Information

- Blockchain can manage critical data such as land records, census data, birth/death records, business licenses, criminal records, IP registry, and electoral rolls.

- Benefit: Creates tamper-proof, secure, and transparent public ledgers.

2. Fight Corruption

- Blockchain helps register government transactions, creating a transparent, trusted history of all transactions.

- Benefit: Enhances auditing, reduces corruption, and promotes transparent public procurement.

3. Cut Red Tape

- Government databases often lack interoperability, causing data duplication, overlap, and delays.

- Benefit: Blockchain eliminates redundancy, streamlining data sharing between agencies and reducing bureaucratic barriers.

4. Identity and Land Rights

- Blockchain can securely store personal identifiers like birth certificates and university degrees.

- Benefit: Enables users to control their data and share it globally while maintaining privacy.

- Example: Governments in Dubai, Estonia, Georgia, and Sweden are exploring blockchain for secure property rights.

5. Agriculture

- Blockchain improves transparency, reducing food fraud and contamination.

- Benefit: Ensures fast payments to farmers and distributors, increasing operational efficiency and trust.

6. Health

- Blockchain improves digital healthcare records and pharmaceutical supply chain management.

- Benefit: Provides decentralized, secure, and efficient solutions for healthcare data management.

- Example: Blockchain in drug supply chains to prevent counterfeit medicines.

7. Governance and Democracy

- Digital Identity Management: Blockchain-based IDs ensure data privacy and security.

- Voting Systems: Cryptocurrencies enable tamper-proof, blockchain-based voting platforms. Example: Estonia’s e-residency program incorporates blockchain technology.

8. Environmental Protection

- Blockchain in supply chain management tracks products from farm to table, ensuring transparency.

- Benefit: Verifies the authenticity of organic and Fair Trade products, supporting sustainability.

9. Philanthropy and Aid

- Blockchain ensures transparency in the distribution of aid, reducing misuse.

- Benefit: Increases confidence in non-profits and ensures funds reach those in need.

10. Crowdfunding

- Blockchain-powered crowdfunding campaigns accept cryptocurrencies like bitcoin.

- Benefit: Secures investments for new projects, with transparent tracking of donations and project progress.

Challenges of Cryptocurrency

| Challenge | Description |

| Volatility | Cryptocurrencies experience high price fluctuations, making them risky for investment and daily transactions. Example: Bitcoin’s price surged to nearly $20,000 in 2017, only to drop below $4,000 in 2018. |

| Scalability | Many blockchain networks face challenges in processing a large number of transactions quickly and efficiently. Example: Bitcoin’s blockchain can process only 7 transactions per second, whereas traditional payment systems like Visa can handle thousands. |

| Lack of Consumer Protection | Since cryptocurrencies are largely unregulated, there are no consumer protections against fraud, mistakes, or losses.Ponzi Schemes and Pump-and-Dump Schemes: Many fraudulent projects have emerged in the cryptocurrency space, misleading investors.If a user loses their private key or is scammed, there is no central authority to provide support.Example: Rug pulls in decentralized finance (DeFi) projects, where developers create a project and then disappear with investors’ funds, are a common issue. |

| Regulatory Uncertainty | Governments and regulators are still developing frameworks for cryptocurrency, leading to uncertainty. Example: China has banned cryptocurrency trading and mining, while countries like El Salvador have adopted Bitcoin as legal tender. |

| Security Risks | Despite strong encryption, cryptocurrencies are still vulnerable to hacking, theft, and fraud.Example: In 2018, Coincheck (a cryptocurrency exchange) lost $500 million in a hack. |

| Lack of Adoption | While growing, the adoption of cryptocurrencies for everyday use is still limited.While companies like Tesla and PayPal have started accepting cryptocurrency, most businesses still only accept traditional forms of payment. |

| Environmental Impact | Cryptocurrency mining, particularly Bitcoin, consumes vast amounts of electricity due to the energy-intensive Proof-of-Work (PoW) process.Some cryptocurrencies are exploring more sustainable alternatives like Proof-of-Stake (PoS), which requires less energy.Example: Bitcoin mining consumes as much electricity as some small countries, such as Argentina. |

| Irreversible Transactions | Once a transaction is completed on the blockchain, it cannot be undone, which can be problematic in case of errors or fraud. |

| Anonymity and Criminal Use | Cryptocurrencies can be used for illicit activities due to the anonymity they offer, raising concerns for law enforcement. Example: The Silk Road darknet marketplace allowed users to buy illegal drugs and weapons using Bitcoin. |

| Complexity | Understanding how cryptocurrencies work, including wallets, private keys, and blockchain technology, can be difficult for new users. Example: Losing access to a cryptocurrency wallet without a backup key can result in the permanent loss of all funds. |

| Integration with Traditional Systems | Cryptocurrencies face challenges when integrating with traditional financial systems, limiting their usability in some areas. |

| Market Manipulation | Due to the relatively unregulated nature of cryptocurrencies, market manipulation through “whales” or large players is a concern. |

Cryptocurrency in India

Why is Crypto Regulation Important in India?

- Protection Against Financial Crime →Combat money laundering and terrorism financing

- Financial Stability → Prevents systemic risks from unregulated crypto markets.

- Innovation and Growth → Clear regulations attract legitimate businesses and investments.

Cryptocurrency Regulations in India

- Legal Status of Cryptocurrency:

- Cryptocurrencies are not legal tender in India but are allowed for trading and investment.

- Taxation: A 30% tax on crypto gains and 1% Tax Deducted at Source (TDS) for transactions above a certain threshold.

- Key Regulatory Bodies:

- RBI: Issues warnings and is critical of decentralized cryptocurrencies.

- SEBI: Advisory role, would regulate crypto if classified as securities.

- Ministry of Finance: Focuses on crypto taxation and tracking illicit activities through the Travel Rule under PMLA.

- RBI’s Stance:

- Initially banned cryptocurrency transactions in 2018, but the Supreme Court lifted the ban in 2020.

- Concerns: Financial risks, market volatility, and threats to the rupee’s integrity.

- Digital Currency Bill 2021:

- The bill proposes banning private cryptocurrencies but promotes blockchain technology in other sectors.

- Supports the development of an official Central Bank Digital Currency (CBDC) issued by the RBI.

Virtual Digital Assets

‘Virtual digital asset’ refers to any information, code, number, or token (not being Indian currency or foreign currency) generated through cryptographic means or otherwise and can be called by whatever name.

Eg.Crypto currencies like Bitcoin, NFTs etc Transactions come under the purview of the Prevention of Money Laundering Act (PMLA).

Extra : VDAs was introduced in the Finance Bill 2022 to provide for taxation and withholding of tax pertaining to VDAs. Effective from 1 April 2022 onwards, any income from transfer of VDAs is taxable at the rate of 30% (plus surcharge and cess).

Global Comparison

- United States:

- Decentralized regulatory bodies like the SEC, CFTC, and FinCEN.

- Taxed as property with capital gains tax.

- European Union:

- Developing Markets in Crypto-Assets Regulation (MiCA Regulations) for uniform regulations.

- Varies by country on how crypto is taxed.

- Japan:

- Recognizes cryptocurrencies as legal tender, regulated by the Financial Services Agency (FSA).

- Gains taxed progressively (15%-55%).

Cryptocurrency Exchanges in India

- WazirX: One of the largest and most popular exchanges in India.

- Offers trading in major cryptocurrencies like Bitcoin, Ethereum, Ripple etc.

- CoinSwitch Kuber, ZebPay, Unocoin, Bitbns, Koine

Indian Crypto Startups and Innovations

- Polygon (Previously Matic Network): A blockchain scaling solution aimed at making Ethereum transactions cheaper and faster.

- CoinDCX: A prominent crypto exchange offering the ability to buy, sell, and trade cryptocurrencies.

- Instamojo: Initially a payment gateway, now expanding into blockchain solutions.

- Unocoin, Cashaa

Central Bank Digital Currency (CBDC)

What is CBDC?

- It is a digital form of a country’s fiat currency, issued and regulated by the central bank.

- Unlike cryptocurrencies (e.g., Bitcoin), CBDC is state-backed, secure, and governed by the country’s central bank.

Key Developments in CBDC:

- May 2020: People’s Bank of China (PBC) began trials to issue its fiat currency (Yuan/Renminbi) in digital form, showcasing global interest in CBDC.

- Dec 2021: RBI suggested India should start with basic CBDC models due to their dynamic impact on microeconomic policy.

Types of CBDC:

- Wholesale CBDC: Used by financial institutions for transactions between them.

- Retail CBDC: Available to the general public for payments, similar to physical currency but in digital form.

Benefits:

- Cost Savings: No need for printing or transporting physical currency.

- Reduced Counterfeiting: Digital currency eliminates the risk of fake money.

- Traceability: Tracks transactions, reduces fraud and tax evasion.

- Example: Auto-alerts for tax evasion.

- Control Over Cryptos: Reduces risks of terrorism financing and illegal activities.

- Fast Disbursal: Instant money transfer to beneficiaries (e.g., pensions, subsidies).

- Programmable Currency: Automatically controls spending (e.g., student loan interest rate adjustment).

- Health Safety: Reduces virus spread by minimizing physical currency handling.

Challenges:

- Digital Divide: Limited access to internet or digital literacy in rural areas.

- Cybersecurity Risks: Vulnerability to cyber attacks or natural disasters.

- Privacy Concerns: Risk of surveillance due to traceable transactions.

- Adoption Issues: Not all businesses or regions can accept digital payments.

Conclusion:

- CBDC can supplement physical currency but cannot replace it entirely.

- It improves financial systems, supports financial inclusion, and modernizes payments, but physical currency remains important for India.

Current Status in India:

- The RBI has initiated pilots for the digital rupee (e₹), with

- Wholesale pilot (e₹-W) launched in November 2022 and

- Retail pilot (e₹-R) in December 2022 in select cities.