Auditing is a foundational chapter in the subject Accounting & Auditing that explains what auditing is and why it is important in financial reporting. It highlights the purpose of auditing, such as ensuring accuracy, detecting errors and fraud, and building trust in financial statements. This chapter sets the stage for understanding the broader role of auditing in business and governance.

Auditing

Previous Year Questions

| Year | Questions | Marks |

| 2023 | Give any four objectives of Auditing. | 2 M |

| 2023 | Write down elements of Auditing as per the definition given by International Auditing & Assurance Standards Board (IAASB). | 2 M |

| 2023 | Write down any four duties of the Comptrollér and Auditor General of India. | 2 M |

| 2021 | What is the designation of a person having the highest authority in a Government Audit? | 2 M |

| 2018 | Define Efficiency Audit | 2 M |

| 2018 | What is Social Audit ? | 2 M |

| 2016 | Write any two differences between Internal Check and Internal Audit. | 2 M |

| 2016 | Give any two differences between Efficiency Audit and Performance Audit. | 2 M |

| 2016 | Mention five points that give significance to social audit. | 5 M |

Meaning & Objectives of Auditing

The term audit is derived from the Latin term ‘audire,’ which means ‘to hear’. In the early days, an auditor used to listen to the accounts read over by an accountant in order to check them.

- Auditing is as old as accounting. It was in use in all the ancient countries such as Mesopotamia, Greece, Egypt, Rome and India.

- The Vedas contain reference to accounts and auditing.

- Arthashastra by Kautilya detailed rules for accounting and auditing of public finances.

- In India, the Companies Act, 1913 made audit of company accounts compulsory. It also prescribed for the first time the qualification of auditors.

Definition

- Spicer and Pegler : Auditing is the examination of books of accounts and vouchers to ensure that the balance sheet presents a true and fair view of the business’s financial position and that the profit and loss account accurately reflects the financial results for the period. If not, the auditor must specify the discrepancies.

- Prof. L.R.Dicksee : Auditing is an examination of accounting records undertaken with a view to establish whether they correctly and completely reflect the transactions to which they relate.

- According to the Ministry of Finance, “Auditing is the systematic and independent examination of financial records, transactions, documents, and procedures of an organization by a qualifiedprofessional, known as an auditor”.

Features of Auditing :

On concluding various definitions, The meaning of an Audit contains:

- Audit is a systematic and scientific examination of the books of accounts of a business.

- Audit is undertaken by an independent person or body of persons who are duly qualified for the job.

- Audit is a verification of the results shown by the profit and loss account and the state of affairs as shown by the balance sheet.

- Audit is a critical review of the system of accounting and internal control.

- Audit is done with the help of vouchers, documents, information and explanations received from the authorities.

- The auditor satisfies himself with the authenticity of the financial accounts prepared for a particular period.

Basic Principles of Audit

AAS-1 (Auditing and Assurance Standards board under the council of Institute of Chartered Accountants) describes the basic principles which govern the auditor’s professional responsibilities and which should be complied with whenever an audit is carried out. These are:

- Integrity, objectivity and independence

- Confidentiality

- Skill and competence

- Work performed by others

- Documentation (The auditor should document matters which are important)

- Planning

- Audit evidence

- Accounting system and internal control

- Audit conclusions and reporting

Objectives of Auditing

There are two main objectives of auditing classified as the primary objective and the secondary or incidental objective.

Primary:

- Ascertaining the validity of financial statements : Compliance verification with relevant accounting standards.

- Completeness of financial statements, providing stakeholders with confidence in the integrity of the financial reporting process.

- Express an opinion on whether the financial statements present a true and fair view of the organization’s financial position and performance. (As per Section 227 of the Companies Act 1956)

Secondary:

- Detection and prevention of Error.

- Detection and prevention of Fraud.

- Risk Assessment: Evaluate financial risks the organization faces, enabling management to implement appropriate risk management strategies.

- Stakeholder Confidence: Increases the credibility of financial information.

Types of Error:

Accounting errors are the errors committed by persons responsible for recording and maintaining accounts of a business firm in the course of the accounting process. These errors may be in the form of omitting the transactions to record, recording in wrong books, or wrong account or wrong totalling and so on.

Classification of Error

- Clerical Errors: Such an error arises on account of wrong posting. For example, an amount received from R is credited to S. Though there is wrong posting still the trial balance will agree. Clerical errors are of 3 types

- Errors of commission: Due to ignorance, carelessness or lack of knowledge, e.g., writing ₹115 instead of ₹151. These errors may or may not affect the agreement of trial balance.

- Errors of Omission: Arises when the transaction is not recorded in the book books of original entry or posted to the ledger. Omission may be complete or partial.

- Compensating Errors: One mistake cancels out another, keeping the trial balance unaffected, e.g., debiting ₹200 instead of crediting ₹200.

- Errors of principle: Occur when accounting principles are not followed, e.g., treating an asset purchase as an expense.

Types of Frauds:

Fraud refers to an intentional act by one or more individuals among management, employees, or third parties, which results in a misrepresentation of financial statements. Following are the types of frauds:

- Manipulation of accounts

- Misappropriation of cash

- Misappropriation of Goods

Window Dressing:

- It refers to the manipulation of financial statements to present a more favorable view of a company’s financial position than reality.

- Used to attract investors, secure loans, or enhance market reputation.

- Examples:

- Overstating revenue or profits.

- Delaying expense recognition.

- Showing inflated asset values.

Secret Reserves:

- These are hidden reserves created by deliberately undervaluing assets or overstating liabilities.

- Helps in financial stability and tax reduction but lacks transparency.

- Examples:

- Charging excessive depreciation.

- Writing off good assets.

- Undervaluing stock.

Types of Audit Report:

- Clean (Unqualified) Report: The financial statements are accurate and free from material misstatements.

- Qualified Report: Most information is correct, but there are minor issues that do not affect overall accuracy.

- Adverse Opinion: The financial statements contain significant misstatements and do not present a true picture.

- Disclaimer of Opinion: The auditor is unable to express an opinion due to lack of sufficient information.

Benefits OF Audit:

- Detection & Prevention of Errors and Frauds: Helps identify mistakes and fraudulent activities, ensuring financial accuracy.

- Reliability of Financial Statements: Assures stakeholders (investors, creditors, government) that financial records are fair and accurate.

- Legal Compliance: Ensures adherence to accounting standards, tax laws, and company regulations.

- Improved Internal Control: Strengthens internal checks, preventing mismanagement of resources.

- Enhances Business Reputation: Boosts investor and customer confidence in the organization’s financial health.

- Facilitates Decision-Making: Provides accurate financial insights for better planning and management.

- Assists in Loan & Investment Approvals: Banks and investors rely on audited statements before granting loans or funding.

- Moral Check (check the minds of the staff working → prevents irregularity).

- Evidence in court.

Limitations of Audit:

- Based on the Information provided by the Management (so outsiders cannot fully rely on the auditor’s report).

- Non detection of errors/frauds which are committed with malafide intention.

- Based on Estimates : Some figures, like depreciation or provisions, are based on estimates, which may not be accurate.

- Subjectivity in Judgments: Auditors rely on their professional judgment, which may vary from person to person.

- Auditors can not justify the intention of transactions.

- Inherent limitations of the financial statements:

- Do not reflect current values of assets and liabilities.

- Non-monetary factors can not be measured.

- Higher Cost Burden (Limits in depth checking)

Difference Between Accounting and Auditing

| Aspect | Accounting | Auditing |

| Meaning | It is the recording of all the day-today transactions in the books ofaccounts leading to preparation offinancial statements. | It is the critical examination of the transactions recorded in the books of accounts. |

| Nature | It is concerned with finalisation ofaccounts. | It is concerned with establishment of reliability offinancial statements. |

| Objective | To determine a company’s profit or loss and to present its financial position for a specific period. | The objective is to certify thecorrectness (true and fairness) of financial statements. |

| Commencement | Accounting commences when Book-keeping ends. | Auditing begins when accountingends. |

| Scope | It involves various financialstatements. It involves maintenanceof books of accounts. It does not gobeyond books of accounts. | It goes beyond the accounting books and reviews internal controls and financial policies. |

| Qualifications | No formal qualifications are required for accountants. | Auditors must be qualified chartered accountants certified by the Institute of Chartered Accountants of India. |

ELEMENTS OF AUDITING:

- Planning: Setting up the audit’s goals, scope, and methods beforehand.

- Materiality: Deciding what financial information is significant enough to influence decisions.

- Evidence: Gathering enough relevant data to back up the auditor’s conclusions.

- Internal Control Evaluation: Reviewing how well an organization’s processes prevent errors and fraud.

- Risk Assessment: Identifying potential problems that could affect the financial reports.

- Documentation: Recording all audit procedures and findings for reference and review.

- Reporting: Providing a detailed report that states if the financial statements are accurate and fair.

- Follow-up: Checking to ensure any issues found during the audit are addressed.

Social Auditing

Social audit is a systematic and critical evaluation of government programmes/schemes, collaboratively conducted by stakeholders – community members, NGOs, and beneficiaries – to assess social service delivery effectiveness.

- Social Audit is the examination and assessment of a programme/scheme conducted with

- the active involvement of people and comparing official records with actual ground realities.

- Thus social audits examine and assess the social impact of specific programmes and policies.

- Social Audit is a powerful tool for social transformation, community participation and government accountability.

- Social audit is a tool for social accountability and transparency.It is called non-financial auditing.

- For example, Gram Sabha conducts social audits of all works under Sec. 17 of MGNREGA act.

Social Auditing in India:

- The first organisation in India to conduct social audits was Tata Iron and Steel Company Ltd. (TISCO), Jamshedpur, in 1979.

- After the 73rd Constitutional Amendment, which supports Panchayati Raj Institutions, the importance of social audit increased.

- The Ninth Five Year Plan (1997-2002) highlighted its necessity for effective local governance and decentralization in India.

- Kerala has implemented social audits for local bodies to enhance transparency and accountability.

Note : The Sustainability Reporting Standard Board (SRSB) of ICAI is responsible for establishing social audit standards in India.

Objectives of Social Audit

- Verify the implementation of a program/scheme and its results by the community with the active involvement of the primary stakeholders.

- Promoting transparency and accountability in the implementation of a programme.

- Providing a collective platform for people to express their needs and grievances.

- Strengthening the schemes by deterring corruption and improving implementation.

Principles of Social Audit:

- Low Cost: Social audits are cost-effective as they involve community members, civil society, NGOs, etc., eliminating the need for substantial expenditures on hiring independent auditors. For instance, the Society for Social Audit, Accountability, and Transparency (SSAAT) in Rajasthan, Jaipur, conducts social audits for six government schemes.

- Participatory: Encourages active involvement of stakeholders and values their input. For example, Gram Sabha conducts social audits under section 6(1) of MGNREGA Audit Rules, 2011, ensuring the active involvement of local communities in the evaluation process.

- Comprehensive: Aims to report on all aspects of the organisation’s work and performance.

- Multi-Perspective/Polyvocal: Aim to reflect the views (voices) of all those people (stakeholders) involved with or affected by the organisation/program.

- Multidirectional: Stakeholders share and give feedback on multiple aspects.

- Comparative: Helps the organization compare its performance over time and with similar organizations, using benchmarks or industry standards.

- Verified: Social audit results should be reviewed by an independent expert to ensure accuracy and credibility.

- Regular – Social audits should be conducted regularly to become a part of the organization’s culture.

- Disclosure – The audited reports should be shared with stakeholders and the community to maintain transparency and accountability.

Benefits of Social Audit

- Raises public awareness and knowledge.

- Promotes citizen empowerment and strengthens community voice by allowing community members to provide feedback, gather evidence, interpret findings and develop solutions.

- Promotes local democracy and collective decision-making.

- Enhances policy-makers’ understanding of stakeholder concerns and encourages them to take steps to address the same.

- Improves the design, delivery and effectiveness of programs and services.

- When institutionalised, social audits allow for regular monitoring of public institutions, enhancing the legitimacy of state actors and enhancing the trust between the citizens/CSOs and the government.

- Enhances transparency by demanding information and supporting laws like the Right to Information.

- Curb on corruption

- A sense of belonging (Personal touch with People, since people participate in the audit).

- Awareness to Common people their rights and entitlements.

- Social Accounting and Reporting

- Good Local Governance

- Grievance redressal and follow up of corrective actions.

Tools of Social Audit:

Citizen charters, Public expenditure tracking surveys (PETS)

Challenges/Limitations associated with Social Audit:

- Lack of Awareness: Many stakeholders, including local communities, are unaware of the concept and benefits of social auditing.

- Stakeholder Engagement: Difficult to maintain unbiased and diverse participation.

- Data Collection: Gathering precise and relevant qualitative data is challenging.

- Resource Constraints: Limited resources can hamper the depth and frequency of audits.

- Expertise: Specialized skills for handling complex data are often lacking.

- Transparency vs. Confidentiality: Balancing openness with privacy concerns can limit honest feedback.

- Standardization: Variability in audit methods leads to inconsistent results.

- Impact Assessment: Measuring subjective social and environmental impacts is complex.

- Cultural Sensitivity: Cultural differences can influence audit accuracy.

Performance Auditing

- A performance audit is an independent evaluation of an organization, project, or program to assess whether it is achieving its intended outcomes effectively and efficiently.

- It measures the performance of a system, policy, or project in relation to its stated objectives, and it provides recommendations for improvement.

- It is called complete auditing.

- The CAG’s Performance Auditing Guidelines 2014 define a Performance audit as an independent assessment or examination of the extent to which an organization, Programme, or scheme operates economically, efficiently, and effectively (3E).

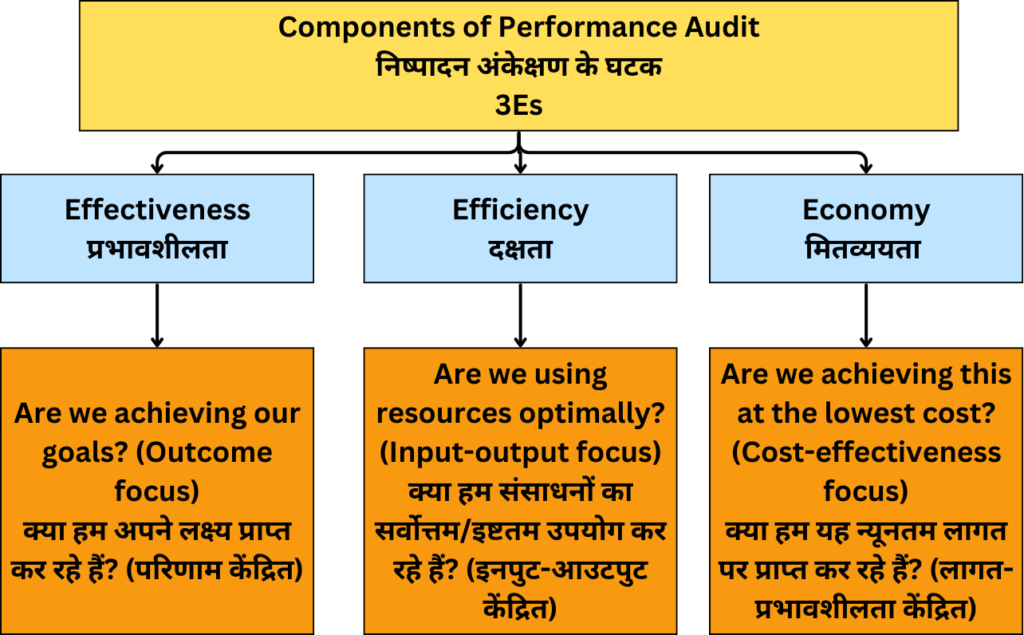

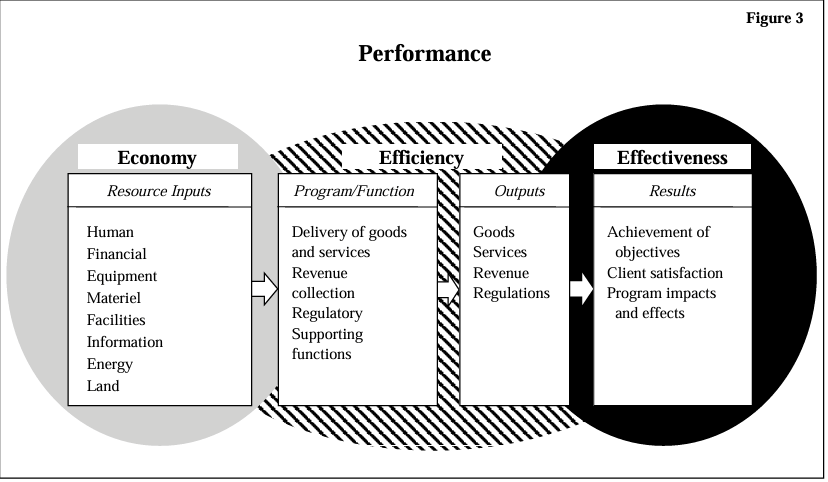

Components of Performance Auditing (3Es):

- Economy: Is there cost-effectiveness without waste? Resources are acquired at economical price with due regard to appropriate time, quality and quantity.

- Efficiency: Are resources utilized optimally for desired results? After acquiring resources their proper use to produce maximum output.

- Effectiveness: Whether the expenditure occurred meets the intended goals and objectives?

Elements of Performance Audit:

Public Sector audits have certain basic elements

- Three parties in the audit → the auditor, the responsible party, the intended user,

- The subject matter information and

- Criteria to assess the subject matter.

Types:

- Financial A/c

- Operational A/c

- Law Compliance

Significance:

- Promote economical, effective and efficient governance.

- Optimum use of resources.

- Enhances accountability and transparency of the organisation. (Proper monitoring of schemes/programmes)

- Enhances organisational performance by identifying areas of improvement.

- Ensure compliance with laws and regulations.

- Improve decision-making by providing various insights.

- Confidence in stakeholders increases.

Efficiency Auditing

- Efficiency audit entails assessing “how effectively an organization utilizes its resources to achieve its objectives”, ensuring that every rupee invested yields optimum results by optimizing processes, systems, and resource allocation.

- It refers to the relationship between input and output.

- In essence, efficiency indicates how well an organization uses its resources to produce goods and services. Thus, it focusses on resources (inputs), goods and services (outputs), and the rate (productivity) at which inputs are used to produce or deliver the outputs.

- It tells about the area where an organization can improve its performance, reduce cost and increase productivity. Eg- analyzing cost per unit.

Objectives of efficiency audit:

- Optimum utilization of investment.

- To diagnose the operational weakness.

- To assess the effectiveness of measures and techniques adopted.

- To evaluate and compare the optimum return on capital invested in business operations.

- Identify areas for cost reduction.

- Streamline processes.

The parameters based on which Efficiency Audit is conducted are:

- Return on capital

- Capacity utilization

- Optimum utilization of men, machines, and materials.

Significance:

- Cost-effectiveness

- Enhances efficiency, effectiveness.

- Improve decision making

- Increase the quantity or improve the quality of outputs and level of service without increasing spending.

- Identify needed improvements in organisation for better use of resources.

Difference between Performance Audit and Efficiency Audit

| Parameter | Performance Audit | Efficiency Audit |

| Focus | Primarily assesses how well an organization achieves its goals and objectives.It focuses on the effectiveness of processes, programs, or policies. | Primarily assesses the optimal use of resources in achieving the organization’s goals.It focuses on resource utilization—whether resources (time, money, manpower, etc.) are being used in the most cost-effective way. |

| Objectives | Measures outcomes such as quality, customer satisfaction, and goal fulfillment. | Focuses on cost reduction without sacrificing quality or productivity. |

| Metrics | Uses qualitative metrics (e.g., customer feedback, quality of service) and quantitative metrics (e.g., sales, production targets, compliance rates). | Uses metrics related to resource consumption and cost-effectiveness (e.g., return on investment, unit costs, cost per unit of output). |

| Scope | Broader in scope, as it encompasses overall organizational goals, project/program outcomes, and effectiveness across different departments or processes. | Narrower in scope, as it focuses specifically on the resource usage involved in performing tasks or activities. |

| Outcome | The outcome often leads to recommendations for improving effectiveness, such as modifying programs or processes to better meet objectives. | The outcome often leads to recommendations for improving resource allocation, such as optimizing budgets, reworking workflows, or using automation to reduce costs. |

| Examples | Reviewing a government program to see if it meets its stated social or economic objectives, like reducing unemployment or improving public health. | Examining a company’s supply chain to reduce production time or minimize transportation costs. |

Elementary knowledge of Government Audit

- A government audit is an objective, systematic, professional and independent examination of the financial transactions of a public entity to ensure they are executed properly under sanctions and authorities and are correctly recorded in books of account.

- It aims to ensure the accountability of the executive with respect to public revenue and expenditure.

Here, the government sector includes

- Union & State Government

- Audit by CAG)

- Government Companies (PSUs)

- Internal audit

- Statutory audit (by C.A.)

- CAG

- Government Department

- Internal audit

- CAG report

Objectives:

- Transparency in the use of taxpayers’ money.

- Compliance with Law.

- Public funds are being used efficiently & effectively.

- Verification of public debt, Liability, and Assets of govt.

- Review revenue and capital receipt of govt as per target.

- To verify whether the expenditures of govt. are as per the rule.

Role of CAG in Govt Audit

In India, the function of the government audit is discharged by the independent constitutional authority of the Comptroller and Auditor General (CAG) through the agency of the Indian Audit & Accounts Dept.

- Article 148: Independent office of Comptroller and Auditor-General of India.

- Article 149: Duties and powers of the Comptroller and Auditor-General.

- Duties of CAG are described under Duties, Power & Conditions of Services Act, 1971

- Article 150: Form of accounts of the Union and of the States.

- Article 151: Audit reports

- CAG Report → President of India → Parliament → PAC

Role of CAG:

- Different types of audit

- Expenditure Audit under Section 13 of DPC act, 1971

- Scope: Audits all expenditures from the Consolidated Fund of India, of each State, and of Union Territory with a legislative assembly.

- Responsibilities: Ensures legality, applicability, and conformity of expenditures to governing authorities.

- Components: Includes audits against rules and orders, sanctions, provisions, propriety, and performance audits.

- Audit of Other Funds: expenditure from contingency fund and public accounts.

- Audit of Bodies Substantially Financed: under Section 14 of the DPC Act

- Audit of Receipts: Section 16 empowers CAG to audit the receipts of the Union and State governments.

- Audit of Government Companies and Corporations under section 19

- Expenditure Audit under Section 13 of DPC act, 1971

- Ensuring Financial Accountability: CAG ensures accountability of the executive in terms of public revenue and expenditures to Parliament and state legislatures. The audit reports (A-151) are presented before Parliament or the respective legislature.

- CAG is referred to as the “Chief Guardian of Public Purse.”

- Role with Public Accounts Committee (PAC): CAG acts as a guide, friend, and philosopher of the Public Accounts Committee of Parliament.

Powers of C&AG

- To inspect any office of accounts under the control of the Union or a State.

- To require that any accounts, books, papers, and other documents which deal with or are otherwise relevant to the transactions under audit, be sent to specified places.

Expenditure audits conducted by CAG (Section 13): To ensure that funds are provided by a competent authority, authorizing the limits within which expenditure can be incurred. It includes:

- Audit against ‘Rules and Orders’

- The expenditure incurred conforms to the relevant provisions of the statutory enactment and in accordance with the Financial Rules and Regulations framed by the competent authority.

- Audit of sanctions:

- Ensure that all government expenditures were approved by the appropriate authority.

- Audit against provision:

- To ascertain whether the expenditure was incurred for authorised purposes.

- Propriety Audit:

- Ensure compliance with the general principles of financial propriety and bring out cases of improper, avoidable expenditure.

- Performance Audit:

- Ascertains various programs are being run economically and are yielding expected results. It covers Efficiency, Economy, and Effectiveness Audit.

FAQ (Previous year questions)

Objectives: [Exam me aapko 2 hi likhne hai]

Transparency in the use of taxpayers’ money.

Compliance with Law.

Public funds are being used efficiently & effectively.

Verification of public debt, Liability, and Assets of the government.

Review the revenue and capital receipts of the government as per the target.

To verify whether the expenditures of govt. are as per the rule.

In India, the Comptroller and Auditor General (CAG) is the primary government auditor. The CAG is an independent constitutional authority responsible for auditing all receipts and expenditures of the Union (central) government and the state governments.

Elements of Performance Audit: Public Sector audits have certain basic elements.

Three parties in the audit: Auditor: The person/organization that independently conducts a performance audit.

Responsible Party: The organization or authority that is responsible for the audit.

Intended User: The stakeholders who receive the report, e.g., government, citizens, policy makers.

The subject matter information: The policies, programs, or plans that are evaluated during an audit.

Criteria to assess the subject matter: Audit criteria are audit-specific, reasonable standards of performance against which the economy, efficiency, and effectiveness of operations can be evaluated and assessed.

Classical Approach: This accounting approach shows how a business maximizes profits while following legal and ethical rules and acting in society’s best interest.

Descriptive Approach: In this, social activities are disclosed in narrative form along with financial statements.

Programme Management Approach: In this, the organisation has to disclose its Social Objectives, how it is going to achieve them, and how the feedback and control have been exercised.

Integral Welfare Theoretical Approach: This approachaccounts for both social benefits and social costs in the financial statements.

Pictorial Approach: In this approach, photographs of various welfare activities conducted by the organization are presented in annual reports.

Objectives of Auditing – There are two main objectives of auditing classified as the primary objective and the secondary or incidental objective.

Primary: Ascertaining the validity of financial statements : Compliance verification with relevant accounting standards.

Completeness of financial statements – Ensuring that all transactions are properly recorded, giving stakeholders confidence in the accuracy of financial reporting.

Express an opinion on whether the financial statements present a true and fair view of the organization’s financial position and performance. (As per Section 227 of the Companies Act 1956)

Secondary: Detection and prevention of Error.

Detection and prevention of Fraud.

Risk Assessment: Evaluate financial risks the organization faces, enabling management to implement appropriate risk management strategies.

Stakeholder Confidence: Increases the credibility of financial information.

Elements of Auditing as per definition given by International Auditing & Assurance Standards Board (IAASB) :

Systematic Process

Objectivity & Independence

Evidence (Obtaining & Evaluating)

Management Assertions

Economic Actions & Events

Criteria (Established Standards)

Communication of Results

Interested Users

Duties of Comptrollér and Auditor General of India

To compile accounts of Union and States. In 1976 CAG was relieved from accounting functions.

To prepare and submit accounts to the President, Governors of States and Administrators of Union territories having Legislative Assemblies.

To give information and render assistance to the Union and States regarding accounting and auditing.

To audit all expenditure from the Consolidated Fund of India and of each State and of each Union territory having a Legislative Assembly.

To audit all transactions of the Union and of the States relating to Contingency Funds and Public Accounts.

Audit of receipts and expenditure of bodies or authorities substantially financed from Union or State Revenues.

In India, the function of the government audit is discharged by the independent constitutional authority of the Comptroller and Auditor General (CAG) through the agency of the Indian Audit & Accounts Dept.

Efficiency audit entails assessing “how effectively an organization utilizes its resources to achieve its objectives”, ensuring that every rupee invested yields optimum returns by optimizing processes, systems, and resource allocation.

It focuses on resource utilization – whether resources (time, money, manpower, etc.) are being used in the most cost-effective way.

It tells about the area where an organization can improve its performance, reduce cost and increase productivity. Eg- analyzing cost per unit.

Social audit is a systematic and critical evaluation of government programmes/schemes, collaboratively conducted by stakeholders – community members, NGOs, and beneficiaries – to assess social service delivery effectiveness.

Social audits examine and assess the social impact of specific programmes and policies.

Social Audit is a powerful tool for social transformation, community participation and government accountability.

For example, Gram Sabha conducts social audits of all works under Sec. 17 of MGNREGA act.

Aspect

Internal Check

Internal Audit

Definition

A continuous process where work is divided among employees to prevent errors and fraud.

A systematic examination of financial and operational activities by an independent team within the organization.

Objective

To prevent errors and fraud through division of duties and real-time verification.

To detect errors, fraud, and ensure compliance with policies and procedures.

Timing

Ongoing process, integrated into daily operations.

Conducted periodically (monthly, quarterly, or annually).

Responsibility

Performed by employees within the department as part of their duties.

Conducted by an independent internal audit team.

Scope

Limited to day-to-day transactions and operational processes.

Broader, covering financial records, policies, compliance, and risk management.

Aspect

Performance Audit

Efficiency Audit

Focus

Assesses achievement of goals and objectives.

Evaluates optimal use of resources.

Objectives

Measures outcomes such as quality, customer satisfaction, and goal fulfillment.

Focuses on cost reduction without sacrificing quality or productivity.

Metrics

Uses qualitative (e.g., customer satisfaction) and quantitative (e.g., sales, production targets) measures.

Uses resource consumption and cost-effectiveness-related metrics (e.g., cost per unit, ROI). (Quantitative)

Scope

Broader, covering organizational goals and program effectiveness.

Narrower, focusing on resource utilization in tasks.

Outcome

Suggests improvements in effectiveness and goal alignment.

Recommends better resource allocation and cost optimization.

Examples

Reviewing a government program to see if it meets its stated social or economic objectives, like reducing unemployment or improving public health.

Examining a company’s supply chain to reduce production time or minimize transportation costs.

Significance of Social Audit : Social Audit is a powerful tool for social transformation, community participation and government accountability. It can be explained as follows –

It promotes citizen empowerment and strengthens community voice by allowing community members to provide feedback, gather evidence, interpret findings and develop solutions.

It helps policymakers recognize stakeholder concerns and take necessary steps to address them effectively.

It enhances transparency and accountability by demanding information and supporting laws like the Right to Information.

It promotes local democracy and collective decision-making.

Social audits are cost-effective as they involve community members, civil society, NGOs, etc., eliminating the need for substantial expenditures on hiring independent auditors.

Improves the design, delivery and effectiveness of programs and services.

Social audits identify the gaps and sources of leakages, thus reducing corruption by rectifying it.